What Are The Roles Of A Claim Adjuster

Do you understand this jobs description? Can you mention some of the mandates of a claims adjuster? You can either draw from your former workplace or this particular jobs description. Remember, getting this right will convince the interviewer that you indeed know what your job entails. All the roles should be job-specific.

Please enable JavaScript

Sample Answer

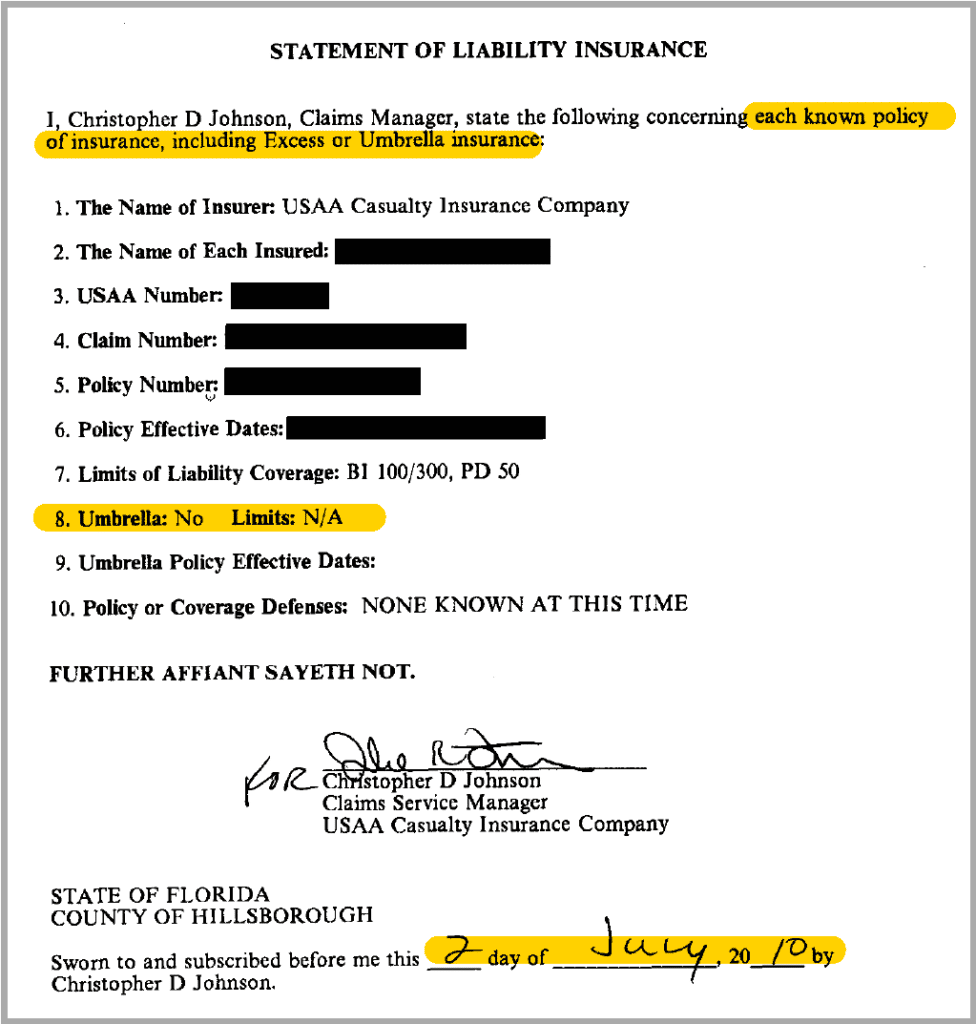

A claim adjuster represents the insurance company. He/she organizes an appraisal, gathers all the relevant facts, and submits the claim details to an insurance company. The adjuster will also inform the claimant whether the particular claim is covered under the policy and, in some instances, act on behalf of the company by negotiating with the policyholder.

Why Do You Want To Work As A Claims Adjuster

Claims adjuster does not belong to jobs children dream about having once theyll grow up. Its a specific position, and you should find some specific reasons for your application.

Maybe you apply only becasue you cant get anything better at the moment, or becasue the job pays relatively well, but you should not say this in an interview. Try to find something positive about the job.

For example you can say that you enjoy the complexity and variety it offers. You will inspect various sites, meet with claimants and witnesses, consult different experts, you will need to use your brain a lot, and your math skills. Its a job for someone who loves variety, in a perspective industry , and thats why you decided for it.

Another reason can be your past experience. Perhaps you worked as a claims analyst or auto damage appraiser, and you would like to continue with your career path. One way or another, they should get a feeling that you really want the job, and made a conscious choice.

What Advice Do Candidates Give For Interviewing At Progressive

- Dont do it but if you really want to work there, just smile and answer the questions correctly.Shared on March 11, 2020 – Claims Adjuster – Austin, TX

- Suck up, smile a lot, if you are a woman dress conservitavely as it will be women interviewing you. Carefull not to toot your horn too much, that scares them.Shared on June 19, 2017 – Property Claims Adjuster – Saint Petersburg, FL

Read Also: When To Send Follow Up Email After Interview

How Will You Go About Obtaining A Full Command Of The Terms Of Our Various Insurance Policies

What you want to hear: Once a Claims Adjuster completes their in-field investigative work, the facts must then be considered along with the terms of the applicable insurance policy in order to draw conclusions about coverage. Listen for a candidate who has a clear plan for learning every provision of the policies relevant to their potential claim assignments, including reading the policies, researching unfamiliar provisions, consulting with supervisors for guidance, attending continuing education courses, and the like.

Red flag: A candidate who does not demonstrate a commitment to being fully educated as a claims adjuster trainee on all relevant policies is a risk for making poor or incorrect coverage decisions.

General Claims Adjuster Interview Questions

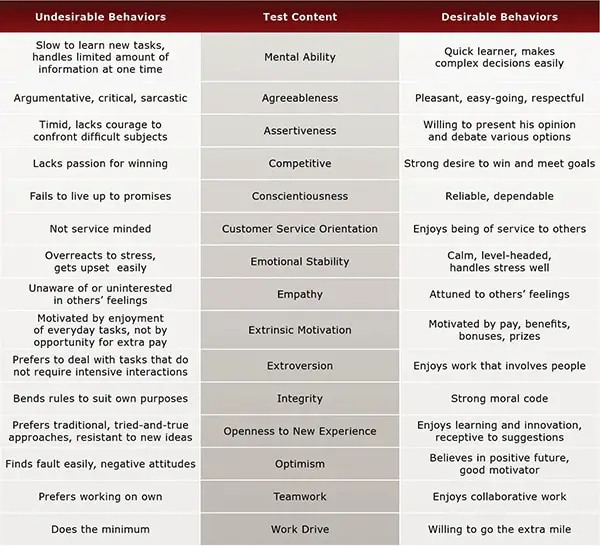

An interviewer may ask general questions to learn more about you. These questions may relate to your personality, interests, expectations and general work experience. Use these questions as an opportunity to highlight your interest in the position and convey how your personality would function within their organization.

Examples of general questions may include:

Tell me something about yourself.

Why do you want to be a claims adjuster?

Are you comfortable working nights and weekends?

What do you know about our company?

Why do you want to work here?

Where do you see yourself in five years?

What’s your greatest strength?

What’s your biggest weakness, and what are you doing to improve it?

How would your current manager describe you?

What would your coworkers say about you?

What motivated you to look for a new job?

What’s something unique you’d bring to this position?

What motivates you at work?

Do you prefer to work alone or with others?

How do you define success?

What are you looking for in your next position?

Describe your ideal work environment.

What types of personalities do you work with the best?

What tools and techniques do you use to stay organized?

What questions do you have for me?

Read more:125 Common Interview Questions and Answers

You May Like: How To Ace My Interview

How Do You Stay Motivated

This is an important question that an interviewer must ask in every interview. Your answer will tell how you manage to push through despite all the challenges in this field. Do not mention anything money-related.

Sample Answer

This job can be pretty stressful. I have more than once had second thoughts. However, the smile I see in devastated peoples faces once I inform them that insurance will cover their damages is heavenly. I love renewing peoples hopes and helping them rise through the ashes. I also engage in several personal activities, such as meditation, that help me deal with the stress.

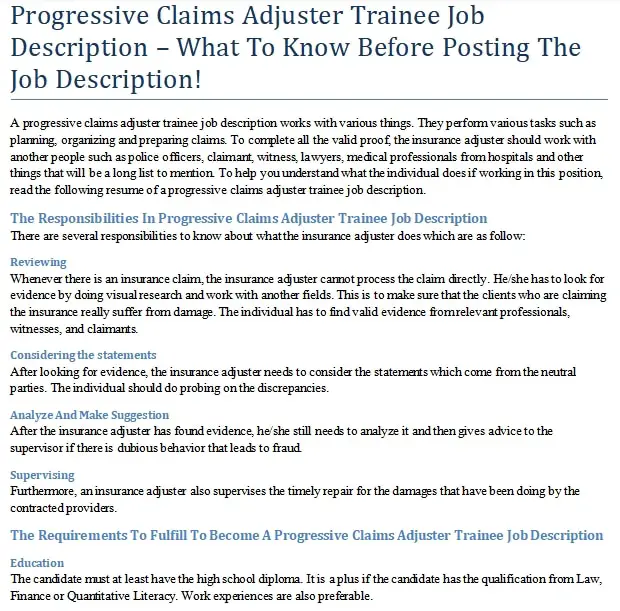

In This Role You Will:

- Investigate and determine coverage onsite of loss and adjusts all elements of Property Loss claims of moderate-high severity.

- Handle moderate- severe complexity claims assigned under little supervision.

- Investigate and evaluate onsite to resolve complex coverage and damage issues to include preparing complete estimates of repair for the covered damages.

- Explain coverage of loss, assists policyholders with itemization of damages, emergency repairs and additional living arrangements.

- Works with and may coordinate a number of vendor services such as contractors, emergency repair, cleaning services and various replacement services.

- Identify suspicious losses. Recommend referral to SIU where appropriate and may assist the SIU in their investigation and settling of the claim.

- May be called upon for catastrophe duty.

Don’t Miss: How To Prepare For My First Interview

What Is Your Ethical Company Culture

It is common for companies nowadays to divide their workforce into different teams, on the basis of their education levels, skills, and type of tasks to be performed for enhanced productivity and related benefits. Thus, an interviewer is always interested in knowing the various qualities and attributes that you want your team members to have. You can share a few common corporate-friendly qualities such as, honest. intelligent, encouraging, supportive, skillful, etc.

What Is The Most Difficult Situation You Have Had To Face And How Did You Tackle It

Note: We do not have professional answers for this career

User Answers

1. I have experience doing essential the same duties. I have also worked to qualify the underserved or uninsured such as your Healthy advantage and Medi-cal.

2. Strong skills in communication, problem solving, and management of claims.

Read Also: Interview Questions For Cna Position In Hospital

Why Do Want To Work As A Claims Adjuster

Note: We do not have professional answers for this career

User Answers

1. I have experience doing essential the same duties. I have also worked to qualify the underserved or uninsured such as your Healthy advantage and Medi-cal.

2. Strong skills in communication, problem solving, and management of claims.

Why Are You The Best Candidate For Us

Note: We do not have professional answers for this career

User Answers

1. I have experience doing essential the same duties. I have also worked to qualify the underserved or uninsured such as your Healthy advantage and Medi-cal.

2. Strong skills in communication, problem solving, and management of claims.

You May Like: What To Ask About Benefits In An Interview

Claims Adjuster Interview Questions At Progressive

Commonly asked questions, as reported by candidates

- First online assessment, basic math and multiple choice behavioral questions. Second a video interview that is computer generated. Eight STAR format behavioral questions. Tell me your previous jobs, Shared on March 28, 2022 – Claims Adjuster – Online video interview

- Standard what would you do questions. There are two interviews and they used canned questions.Shared on July 26, 2020 – Claims Adjuster – Cincinnati, OH

- They never asked about my customer service experience to which I was a top performer at Geico year after year in customer service. But then they told me I needed more experience in customer serviceShared on March 29, 2020 – Claims Adjuster – Video interview

Insurance Claims Adjuster Interview Questions And Answers

Learn what skills and qualities interviewers are looking for from an insurance claims adjuster, what questions you can expect, and how you should go about answering them.

Insurance claims adjusters are responsible for investigating, evaluating, and settling insurance claims. They work with insurance companies, policyholders, and claimants to resolve insurance claims.

If youre looking for a job as an insurance claims adjuster, youll likely need to go through a job interview. During the interview, youll be asked a variety of questions about your experience, skills, and knowledge. To help you prepare, weve gathered some common insurance claims adjuster interview questions and answers.

Are you comfortable working with people who are upset or angry?

Interviewers may ask this question to assess your interpersonal skills and ability to handle challenging situations. In your answer, try to show that you can remain calm and focused in tense situations while still being empathetic toward the persons feelings.

Example:Yes, I am comfortable working with people who are upset or angry. When someone is experiencing a difficult situation, they often feel vulnerable and uncertain about what will happen next. As an insurance claims adjuster, its my job to help them understand their options and provide information on how we can resolve their claim. I always make sure to speak clearly and calmly so that I can be as helpful as possible.

Recommended Reading: Where Can I Watch The Oprah Interview

You Will Probably Meet Clients In Distress When Going About Your Job How Do You Plan To Communicate With Them

The interviewer wants to know if you will be empathetic when dealing with people in distress. Even though you should not allow your emotions to control you, being warm and comforting to such people makes you human. Clearly discuss how you will interact with claimants in distress.

Sample Answer

My time in this field has shown me just how emotional claims can be for others. I always have that in mind and exercise empathy when dealing with such individuals. I will ensure that the client feels comfortable with my pace of taking information.

Claims Adjuster Interview Questions You Should Be Ready To Answer

Once you complete a pre-licensing course with 2021 Training and secure a Texas insurance adjusters license youll be ready to join the workforce. Now, you may choose to get licensed as a staff adjuster or an independent claims adjuster. Regardless, the hiring manager at an insurance company is going to ask you questions to ensure you can adjust claims quickly, efficiently, and that youll represent the company positively on assignment. Insurance adjuster candidates should be able to display excellent interpersonal communication, a keen eye for detail, and quantitative analysis skills during the interview. Below are some questions you should prepare answers to before your first job interview.

You May Like: How To Conduct An Exit Interview

Why Did You Choose To Pursue A Career As A Workers Compensation Claims Adjuster

Note: We do not have professional answers for this career

User Answers

1. I have experience doing essential the same duties. I have also worked to qualify the underserved or uninsured such as your Healthy advantage and Medi-cal.

2. Strong skills in communication, problem solving, and management of claims.

Sample Job Description #2

As a member of the Field Property Claims Team, you will play a vital role in providing an outstanding customer experience by using your investigative and negotiation skills to resolve a variety of homeowner claims in a fast paced, detail-oriented, team environment. In this role, you will travel to the loss site to conduct thorough analysis. Every day is a new exciting challenge, as our Field Property Claims Adjusters use cutting edge homeowners products and services to help our customers through the claims process.

Don’t Miss: Software Engineering Manager Technical Interview Questions

As A Claims Adjuster You Will Be Required To Work Upon Multiple Tasks Simultaneously How Do You Prioritize Between The Different Tasks

Through this question, an interviewer wants to know about your prioritization technique using which you are able to arrange your tasks for the day in a meaningful order. Usually, these tasks are ordered on the basis of time consumption or their difficulty levels. However, you are free to share any other technique as well. But, make sure you are able to explain it completely.

How Would You Ensure You Wouldnt Miss Any Important Information In Your Appraisal Of A Damage Of A Property

You have several good options at this point. When you are just starting in this career field, you can say that you hope to learn everything in your employee training, and from the working manuals. What information to collect, who to consult, and so on.

You can also emphasize your attention to detail and responsibilityyou wont take any case lightly, you will always inspect the damaged property with great care.

If youve already been working in the field, you can list common pitfalls, and talk about experts and consultants who can help you with your judgement of the situation .

You May Like: How To Deny A Candidate After Interview

Insurance Claims Interview Questions

Question: What skills do you believe are required to be successful as an insurance claims handler?

Explanation: This is a general or opening question which the interviewer will ask you early in the interview to start the conversation, learn more about you, and gather the information they can use for subsequent questions.

Example: Working as an insurance claim handler requires a broad range of skills. The most important of these skills is probably attention to detail. You also have to be methodical, a good communicator, a good observer, and possess a great deal of patience. The final skill Ill mention is the ability to read people to determine if they are being truthful with you.

Question: What are some of the typical questions you ask when investigating a claim?

Explanation: This is an operational question. The interviewer is trying to determine how you go about performing the duties of this job. Operational questions are best answered directly with a brief description of the steps you take to accomplish the task about which they are asking.

Example: Since every claim is different, the questions I ask are situational. However, some of the commons ones I would ask for an auto accident include:

Question: What was the most challenging claim in your career, and why?

Question: Thats very interesting. What will you do to make sure our company avoids similar fraudulent claims?

Question: How do you deal with a client who disagrees with your assessment of a claim?

What Would You If An Auto Shop Disputes The Number Of Labor Hours You Estimate For Repairs

An interviewer may ask you this question to determine how well you communicate with other professionals. This is important as claims adjusters often work with mechanics, engineers and similar professionals to coordinate services. Explain how you would resolve the issue, and share an example if you have one.

Example answer:”I experienced this often in my previous position because the shops typically wanted more hours than we estimated. To ensure I provided a fair and accurate estimate, I would ask the mechanic to provide their estimate for hours. If it was similar to mine, I would update my estimate accordingly. However, if there was a significant difference, I would reassess the estimate completely and, if necessary, seek a second opinion.”

Also Check: What Are Star Interview Questions

What Causes You Stress On The Job How Do You Handle That Stress

Note: We do not have professional answers for this career

User Answers

1. I have experience doing essential the same duties. I have also worked to qualify the underserved or uninsured such as your Healthy advantage and Medi-cal.

2. Strong skills in communication, problem solving, and management of claims.

How Do You Manage Stress

There are a number of things that may cause stress in this field. Managing a heavy workload, traveling to disaster areas, and working with upset clients can take a toll on your mental health if you dont have stress management techniques in place. When youre interviewing be sure to have a list of ways you decompress and refocus so they know you can handle any assignment that comes your way.

Recommended Reading: Questions To Ask Technical Interviewer

Mention The Main Challenge That You Will Face In This Role

This is a chance to look around the organization and identify anything that may stress you out later. Remember, the interviewer may use your response to make necessary changes in the organization. Do not, therefore, shy away from pointing out a significant challenge.

Sample Answer

I have seen and overcame several challenges in my career and discovered that most, if not all, are similar in every organization. I cannot, therefore, pinpoint to a specific challenge. However, I will let you know if any that needs your attention comes up later.

Name The Two Most Important Attributes Of A Claims Adjuster

This question tests how much you understand and know about your own profession.

Sample Answer

Sir, In my opinion, Sharp-acumen and Honesty are the two most important virtues of a claims adjuster. This is because, to conduct verification of claims you need to do an investigation, which is possible only when you have a quick-thinking ability and a sharp acumen. Next, you must not fall into the trap of false claims and deceptions by conniving with the policyholders. Hence, you must remain honest and true to your employer, which is possible when you have the trait of honesty.

You May Like: Talent Sourcing Specialist Interview Questions

Latest Claims Adjuster Interview Questions To Prepare

If you are looking to prepare for an interview for a job as a claims adjuster, you definitely need to start thinking about how you will handle the interview that will be taken before you are hired. Simply having a polished resume and a good cover letter is not enough. You need to ace that interview as well if you want that job. Dont worry. We have you covered. Here in this article, we will look at some of the broad questions that are usually asked in an interview for the role of a claims adjuster and what the interviewer will be looking for. We believe that once you get to the end of this article, you will be able to breeze through that interview without breaking into a sweat.