Accounts Payable Accountant Interview Questions

It’s important to prepare for an interview in order to improve your chances of getting the job. Researching questions beforehand can help you give better answers during the interview. Most interviews will include questions about your personality, qualifications, experience and how well you would fit the job. In this article, we review examples of various accounts payable accountant interview questions and sample answers to some of the most common questions.

Select from 7 professional resume templates

Which Information Must You Have For Invoice Approval For Payments

Candidates should respond by identifying a few of the critical factors and bits of information essential for invoice approval. For instance, they should know that checking if the goods or services have been acknowledged is vital, and they should note that verifying the amount is essential. They may also mention that checking whether the organization has been expecting a reduction in cost is important.

How Do You Prevent Duplicate Payments From Being Made

An interviewer would ask “How do you prevent duplicate payments from being made?” to an Accounts Payable Accountant in order to gauge their understanding of Accounts Payable procedures and internal controls. It is important to prevent duplicate payments from being made because it can lead to overspending, which can put the company in a financial bind. Additionally, duplicate payments can damage vendor relationships if they are not reimbursed in a timely manner.

Example: There are a few key things that can be done in order to prevent duplicate payments from being made:1. Ensure that there is a clear and concise approval process in place for all invoices before they are processed for payment. This approval process should include a review of the invoice to ensure that it has not already been paid.2. Implement a three-way match system for invoices, meaning that the invoice must match the purchase order and the goods received before it can be processed for payment.3. Use an automated accounts payable system that includes features such as duplicate invoice detection. This can help to flag any invoices that may have already been paid, or that may be duplicates of other invoices.4. Keep accurate and up-to-date records of all invoices and payments made. This will help to identify any duplicate payments that may have been made, and will also assist in the reconciliation of accounts.

Don’t Miss: How To Do Good On Job Interview

What Do You Understand By Ifa

The term IFA stands for Institute of Financial Accountants. It is a professional accountancy body that represents and provides certification for financial accountants in the United Kingdom. The IFA is a full member of the International Federation of Accountants. It was founded in 1916 with the motto of making small businesses count.

You May Like: Where To Buy Clothes For Interview

Accounting Job Interview Questions

Accounting job interview questions will center on the core accountancy job requirements.

Carefully study the job description or job posting for the accounts payable or accounts receivable job. This will help you to determine the specific accountancy job requirements and the type of questions you are likely to be asked.

We provide some examples of the interview questions you can expect.

Use the excellent interview answer guidelines to prepare your own responses to these accounting job interview questions.

Read Also: Investment Banking Interview Prep Course

What Is Your Experience In Managing Ap Disbursements

The interviewer is likely interested in understanding the Accounts Payable Accountant’s experience in managing AP disbursements because this is an important part of the role. The Accounts Payable Accountant is responsible for ensuring that AP disbursements are made in a timely and accurate manner, and that all relevant documentation is properly filed and maintained. This experience is important because it allows the Accounts Payable Accountant to effectively manage the AP disbursement process and ensure that all payments are made correctly.

Example: I have worked in Accounts Payable for over 10 years and have experience in managing AP disbursements. I have a strong understanding of the Accounts Payable process and have developed efficient methods for managing disbursements. I am able to maintain tight control over AP disbursements and have a proven track record of accurate and timely payments.

Qualifying Accounts Payable Interview Questions

The interviewer may start by asking broad questions about your history, objectives, and experience. Make sure your responses include relevant examples using the STAR approach. Before moving on to more serious matters, the interviewer will ask you these questions to better understand you.

- Are you prepared to sign a non-disclosure agreement and submit it to a background investigation?

- What kind of schooling do you have?

- What kind of work atmosphere do you prefer?

- What do you think you could bring to our team?

- What accounting software do you use regularly?

- How do you ensure that you’re paying accurate bills?

- How frequent are the accounts payable cycle?

- What drew you to finance in the first place?

You May Like: Software Tester Technical Interview Questions

Accounts Payable Interview Questions And Answers

Learn what skills and qualities interviewers are looking for from an accounts payable professional, what questions you can expect, and how you should go about answering them.

If youre looking for an accounts payable job, you can expect to field questions about your experience working with invoices and payments, as well as your knowledge of bookkeeping and accounting principles. In this guide, youll find tips for answering common interview questions that are specific to the accounts payable role.

What made you want to work in accounts payable?

Employers ask this question to learn more about your interest in the role. They want to know what inspired you to pursue a career in accounts payable and how it aligns with their companys mission. When answering, think of a specific moment that made you realize you wanted to work in accounts payable.

Example:Ive always been interested in accounting, but I didnt know there was an opportunity for me until my senior year of college. My professor gave us an assignment where we had to create our own business and keep track of its finances. I chose to start a small bakery, and I loved every part of the process. After that class, I knew I wanted to work in accounts payable.

How do you keep up with the latest news in finance?

What kind of education do you have?

Are you able to multi-task?

Tell me about a time you had to collaborate with others.

Do you have any experience using accounting software?

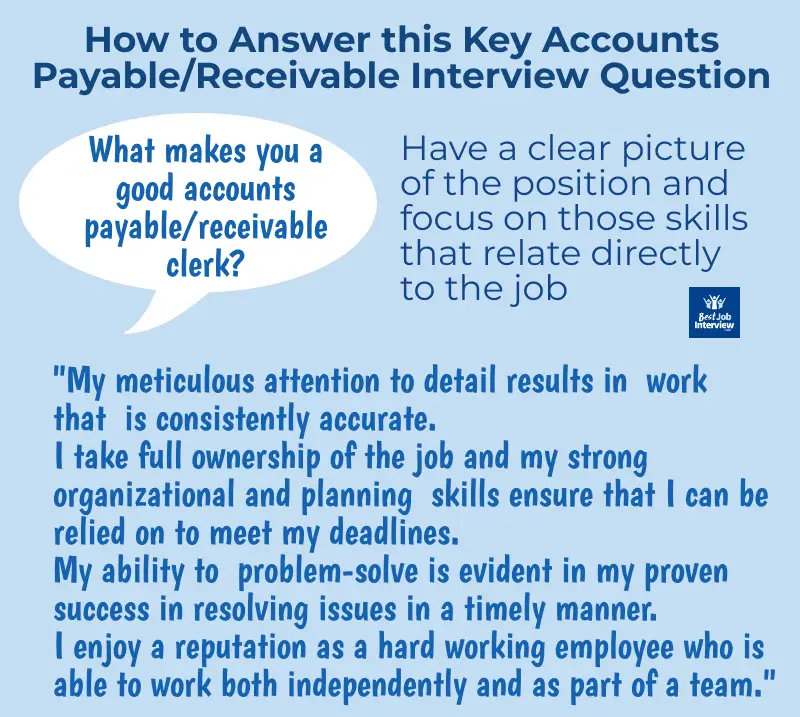

What Are Your Strengths

While this question is an invitation to do some chest pounding, remember to illustrate strengths that will benefit the employer and arerelative to the position. For example:

- being a problem solver

- the ability to perform under pressure

- a positive attitude

Are typically all solid strengths, but again, consider the position. For example, mentioning you are an excellent team player in a job where you largely work alone suddenly becomes irrelevant to the employer and demonstrates a genuine lack of self awareness.

Beyond this, present your strengths with confidence this is not the time to be modest.

You May Like: What To Take To An Interview

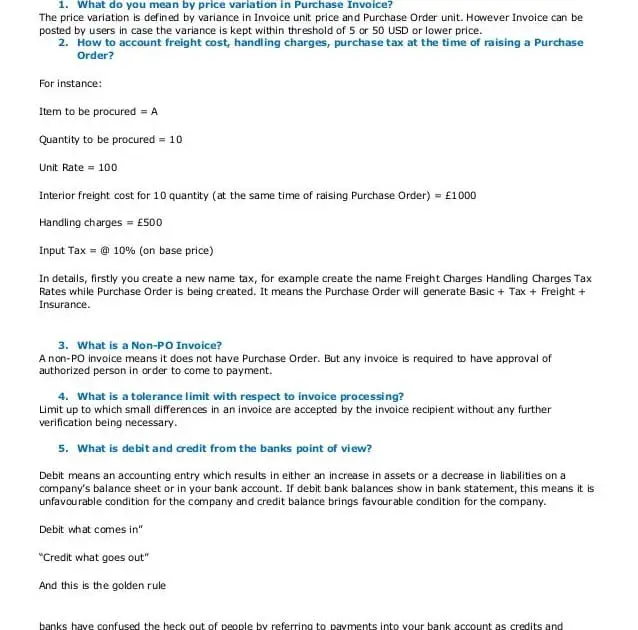

Accounts Payable Questions And Answers:

1. What is VAT ?Value-Added Tax is a tax on consumer spending. It is collected by VAT-registered traders on their supplies of goods and services effected within the State, for consideration, to their customers

2. What is the end to end AP process explain briefly?Accounts Payable process starts with Purchasing and ends payments to Vendors. Workflow is: Purchasing team receive requests-Initiate for quotations from vendors-Purchasing team creates Purchase Order, once the quotation is finalized and obtained all required approvals-PO copy would be sent to Vendor-Vendor will raise an invoice and submit to accounts Payable-Accounts Payable key invoice into ERP-Once the invoice falls on the due invoice will get paid.As this process starts with Procurement and ends with Payments , hence this process also named as to P2P.

3. Do you know how to debit the bank cash book upon withdrawn of cash from the bank?Cash A/c- Real A/c- Debit what comes in & credit what goes out.Cash withdrawn mean cash comes in so it will be debitedBank A/C- personal A/C Debit is receiver & Credit is a giverThe bank is given amount so it will be credited

Contra EntryCr. Bank A/C

4. What is debt from the banks point of view?When we have received the amount from a bank that is a debt to a banker.Is This Answer Correct? 50 Yes 28 No

5. What is three Way Matching Concept?When we creating the invoice in 3-way matching invoice price and no price receipt price should be matched.

36. What form do I use?

What Steps Do You Take Before You Make A Payment

Some of the processes that candidates might mention in response to this question include:

- Checking for holds when the income and expense statement is being coordinated and validated

- Starting the process of approving the invoice if workflow implementation has been completed

- After invoice approval, starting the payment

- Completing the accounting process once the invoice has been endorsed

You May Like: How To Be Ready For A Phone Interview

Don’t Miss: How To Create A Presentation For An Interview

What Do You Understand By The Term Debit Balance How Can We Recover It If We Won’t Have Any Future Transactions From The Supplier

The debit balance is an amount of cash the customer must have in the account as security to follow the execution of a purchase order so that the transaction can be settled correctly. To recover the debit balance, we have to raise a credit memo for the regular vendors. However, if there are no future transactions from the supplier, we ask the vendor to send the check / make an EFT for the amount due from their side.

To recover the debit balance, we can follow up with the vendor to send us the excess amount or refund back, or we can adjust that extra amount in future invoices submitted by that vendor.

How Well Do You Prioritize Numerous Jobs During The Day

Multitasking is a necessary aspect of effective time management, a valuable ability in this sector. This question allows you to demonstrate your flexibility during the workday by providing instances of times when you fulfilled deadlines for numerous projects simultaneously. Please include any times when you had to manage a hectic schedule or coordinate your schedule with other employees.

Example

“At my former employment, I had to report to three different financial officials regularly.” Without jeopardizing the quality of any of my work, I had to keep records, present reports, and schedule meetings with all three of them. I made it a point to have a meticulous personal calendar so that I never missed a meeting or missed a deadline. I was able to finish work on time while maintaining a level head in a chaotic environment because of my schedule.”

Read Also: After Second Interview What To Expect

What Are The Different Types Of Accounting

There are two main types of accounting: financial and managerial. Financial accounting primarily deals with reviewing and reporting transaction information, while managerial accounting is much broader, looking at a companys financial health and future.

However, you can also discuss some other specialties within accounting. For example, cost accountants focus on production and sales costs, typically for industrial companies. Tax accountants, on the other hand, handle registering, preparing, and filing tax returns and tax payments.

What Internal Controls Do You Recommend For Accounts Payable

There are a few key reasons why an interviewer would ask this question to an accounts payable accountant. Firstly, it allows the interviewer to gauge the accountant’s understanding of internal controls and whether they are able to identify potential risks within the accounts payable process. Secondly, it allows the interviewer to assess the accountant’s ability to think critically about how to mitigate risks and improve controls. Finally, this question can provide insight into the accountant’s recommendations for best practices in accounts payable, which can be used to benchmark the company’s current practices against industry standards.

Example: There are several internal controls that can be implemented in Accounts Payable:1. Establish a clear separation of duties between the employees who process invoices and those who approve payments.2. Require all invoices to be approved by a supervisor before they are processed.3. Implement a three-way matching system for all invoices, to ensure that the invoice amounts match the purchase order and the goods or services received.4. Perform regular audits of the Accounts Payable department to ensure that all internal controls are being followed.

Read Also: How To Give Interview On Video Call

What Is Most Challenging About Working As An Accounts Payable Clerk

This question is designed to reveal the challenges that come with the job. It may also be a way to gauge your attitude and personality. Employers want to be sure you know what you are getting into and what working as an accounts payable clerk means. You should show your awareness of the challenges and your ability to resolve them.

Example answer: “The most challenging part of this job is managing the different file formats and managing the various numbers systems. It’s also important to be on the lookout for fraudulent invoices and missing invoices. I am confident that I can make the necessary adjustments to handle these challenges.”

How Would You Handle A Situation Where A Vendor Requests Early Payment

An interviewer would ask this question to an accounts payable accountant to gauge their understanding of accounting principles and procedures. This is important because it shows whether or not the accountant is able to correctly handle vendor requests for early payment.

Example: If a vendor requests early payment, the first thing I would do is check our company policy to see if we allow for early payments. If our company does not have a policy in place regarding early payments, I would then consult with my supervisor or the Accounts Payable Manager to see if this is something that we can accommodate. If we are able to make an early payment, I would then work with the vendor to determine the best way to process the payment. Once all of the necessary documentation has been collected, I would submit the payment for approval and processing.

Read Also: What To Ask During A Job Interview

Do You Get Along Well With Others

Working with other people is essential if you are an account payable clerk because you will frequently be interacting with coworkers and vendors. This question allows you to promote your communication and collaboration skills. Answer that you work well in a team environment and give examples of times you coordinated with a group on a project.

Example

I am very comfortable working as a part of a team. I have always considered myself a social person, and I aim to use my skills to benefit my team and my entire workplace. In the past, I have had to collaborate with coworkers to meet our deadlines on time. I try to utilize my team members skills whenever possible, and I am always willing to offer my help if it benefits the team.

You May Like: How To Prepare For Data Structures And Algorithms Interview

How Have You Managed Accounts Payable In Your Previous Role

There are a few reasons why an interviewer would ask this question to an accounts payable accountant. First, they could be trying to gauge the accountant’s experience with managing accounts payable. This is important because it can help the interviewer understand how the accountant would handle the same duties in the company’s own accounts payable department. Second, the interviewer could be interested in learning more about the accountant’s methods for managing accounts payable. This is important because it can give the interviewer insight into the accountant’s organizational skills and attention to detail. Finally, the interviewer could be trying to determine if the accountant is familiar with best practices for accounts payable management. This is important because it can help the company ensure that its accounts payable department is run efficiently and effectively.

Example: In my previous role, I was responsible for managing the Accounts Payable function for a large organisation. I implemented processes and controls to ensure that all invoices were processed accurately and in a timely manner, and that payments were made in accordance with supplier terms. I also liaised closely with the finance team to ensure that all payments were properly recorded in the accounting system. In addition, I provided training to new staff members on Accounts Payable procedures.

You May Like: How To Prepare For Devops Interview

When Should You Use Accounts Payable Interview Questions

Always remember to use accounts payable interview questions when the candidate sourcing process has finished and after giving your candidates a skills assessment.

Completing the hiring process in this order means that you wont waste time interviewing unskilled or unqualified applicants.

With a skills assessment complete, you can interview your candidates confident that they all have the accounting skills you are looking for.

Explain What Gaap Means

GAAP is an acronym used in accounting to refer to generally accepted accounting principles. Organizations compiling financial statements must use the GAAP acronym when doing so.

The generally accepted accounting principles are the standards outlined by the Financial Accounting Standards Board, whose main aim is to enhance the consistency and clarity of financial details and records.

Read Also: What To Expect From An Exit Interview

Top Accounts Payable Interview Questions And Answers

Here are accounts payable interview questions and sample answers. For someone interested in accounting, an accounts payable clerk position might be a fantastic fit. Your first interview is a crucial step in pursuing this opportunity.

Knowing some of the questions, you’ll be asked ahead of time will help you create a strong first impression.