Module : Interactive Quizzes

This module lets you test your knowledge of the key technical topics by completing quizzes on Core Concepts, Accounting, Equity Value and Enterprise Value, Valuation and DCF Analysis, Merger Models, and LBO Models.

These quizzes are intended to be CHALLENGING even if you have excellent knowledge of the material, you are unlikely to pass with a score of at least 90% on your first attempt.

Once youve tested yourself with these quizzes, you can download the full answer keys to verify that you understand the fundamental concepts.

In total, youll get to test yourself with 218+ questions across all the topics.

- 6 Interactive Quizzes: These cover the core technical topics and expand on the questions and answers covered in the technical sections of the Interview Guide in Module 4. There are many trick questions!

What Is The Difference Between Enterprise Value And Equity Value

Enterprise Value: It is the value of the operations of a company attributable to all providers of capital. It is also important to think of Enterprise value as the takeover value. The main need for enterprise value is to create valuation ratios/metrics.

Equity Value: a component of enterprise value which represents only the proportion of value attributable to shareholders.

Investment Banking Interview Questions

Investment banking interview questions are ofter hyper-technical, involving calculating specific numbers and walking through various investment banking activities. While they can seem overwhelming at first, you can nail an investment banking interview with a little study and preparation.

In this guide, well go over:

Recommended Reading: What To Wear To A Cna Interview

Walk Me Through The Income Statement

Sample Answer:The first line of the Income Statement represents revenues or sales. From that, we subtract the cost of goods sold, which gives gross margin. Subtracting operating expenses from gross margin gives us operating income . We then interest expense , taxes, and other expenses to arrive at Net Income.

Your Answer To The Tell Me About Yourself Or Walk Me Through Your Resume/cv Or Why Are You Here Question

In my 10+ years of conducting mock interviews, Ive never once heard a good initial answer to this question.

Thats why its so tough to win offers in investment banking interviews answer that one question wrong in the first 2-3 minutes, and youre out!

But if you use our templates, and you outline your story and get feedback directly from us, you instantly jump ahead of everyone else in the interview room.

Recommended Reading: How To Get Podcast Interviews

When Should A Company Issue Debt Instead Of Equity

Since the cost of debt is generally cheaper than the cost of equity, there are quite a few situations where issuing debt makes more sense than issuing equity. Issuing debt instead of equity makes sense if:

- The company can get tax shields from issuing debt.

- The company has stable cash flows and can make interest payments.

- It results in a lower WACC.

- The company can get a better return on investments with more financial leverage.

Investment Banker Responsibilities May Include:

- Facilitating relationships with new and existing clients to effectively leverage their network

- Helping broker M& As by acting as a consultant

- Assisting clients with acquisitions and mergers

- Preparing and reviewing material used to finance clients, including presentations, valuations, and transactions

- Staying on top of current events and changes within the industry in order to advise clients to the best of their ability

Also Check: How To Nail A Phone Interview

What Is Beta And Why Would You Unlever It

Beta, symbolized by the Greek character ,is an estimate of how volatile a security is compared to the overall market . The baseline for beta is 1.0, so anything above 1.0 is more volatile and holds more inherent risk.

It is best to use an unlevered beta when comparing a company that is not on the market yet. Additionally, because unlevered beta does not consider debt, it allows you to see the volatility of the companys equity alone as if the company had not taken on any debt.

Tell Me About A Time When You

Tell me about a time when you questions are designed to see how you would react in specific scenarios. For example, the interviewer may ask you to tell them about a time when you disagreed with a manager.

Using the STAR method can help you give clear and concise answers describe the situation and what task or challenge you were dealing with, then say what actions you took to overcome the issue and the outcome of your actions.

You May Like: What Are Good Answers In An Interview

Highlights Of The Investment Banking Interviewguide 40 Include:

- The Quick Start Guide gives you 4-hour, 2-day, and week-long prep plans, so you know what to focus on with limited time. If you have more time than that, great but get the fundamentals right first!

- Pitch Yourself Like a Pro with one of our 18 step-by-step templates for walking through your background in interviews regardless of whether youre an undergraduate, recent graduate, MBA student, career changer, or seasoned executive.

- Gain Conceptual Mastery with 86+ pages of guidance on Fit questions, including how to prepare and examples of good answers in the major categories. Youll be able to discuss your strengths and weaknesses, analytical skills, and teamwork/leadership abilities like its second nature. Altogether, there are 109+ questions with model answers.

- Discuss Deals and Markets Like a Lifelong Banker with 6 sample deal discussions. These discussions correspond to deals the bank has worked on and ones you have worked on. Youll also learn how to research markets and companies efficiently even if its 3 AM, and your interview starts at 9 AM.

- Get Case Study Practice with our 17 Excel-based case studies. These are VERY similar to the types of case studies youd encounter at assessment centers in Europe or standard IB/PE interviews. Youll build 3-statement models, value companies and build DCF analyses, make M& A and investment recommendations, and complete merger models, LBO models, and even a debt vs. equity financing model.

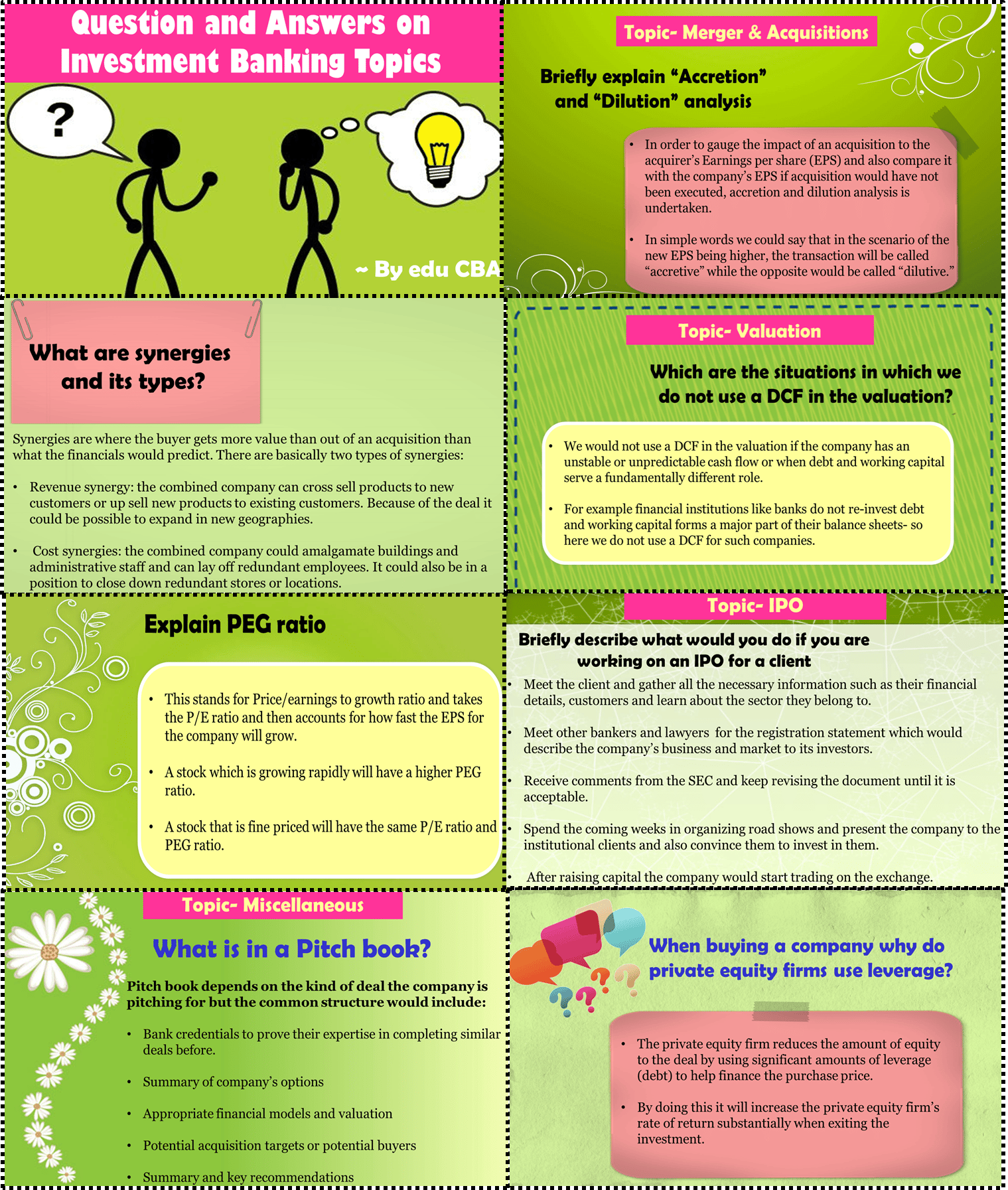

Would You Be Calculating Enterprise Value Or Equity Value When Using A Multiple Based On Free Cash Flow Or Ebitda

Sample Answer:EBITDA and free cash flow represent cash flows that are available to repay holders of a company’s debt and equity, so a multiple based on one of those two metrics would describe the value of the whole business from the perspective of all its investors.

A multiple such as the P/E ratio, based on earnings alone, represents the amount available to common shareholders after all expenses are paid, using which you would be calculating the value of the firm’s equity.

Don’t Miss: How To Prepare For Python Coding Interview

Investment Banking Interview Questions Category : Technical Questions And Answers

For this last category, I do not have any magical tips that will get you results in hours instead of weeks or months.

Put simply, to succeed in investment banking interviews, you need to put in the time to study accounting, finance, valuation, and M& A and LBO modeling.

If you dont, you wont have a great chance against candidates who are obsessed about becoming an investment banker and have spent months preparing.

We cover all these topics comprehensively in our full Investment Banking Interview Guide, but you can also get good introductions to them in our YouTube channel and the articles on this site:

With limited time, focus on accounting, equity value and enterprise value, and valuation and DCF analysis. They are the most common topics, especially in entry-level interviews.

There are thousands of possible questions to test your technical knowledge, so I will list a few representative examples in each of the main categories.

I will focus on questions and answers that you probably havent seen on other sites and other resources, so most of these are in the more challenging range:

What Is An Ipo

An IPO is an initial public offering. Thats when a private company wants to transition to being publicly traded and an investment bank helps sell its shares to investors for the first time. An IPO is sometimes called going public and it can help companies raise capital and allows investors, original owners, and employees to cash-out some of their investments in the company.

You May Like: How To Give Interview On Video Call

Example Finance Questions In Investment Banking Interviews

Finance means concepts such as the Time Value of Money, the Discount Rate, Present Value, and the Internal Rate of Return .

QUESTION: How much would you pay for a company that generates $100 of cash flow every single year into eternity?

ANSWER: It depends on your Discount Rate, or targeted yield.

If your Discount Rate is 10%, meaning you could earn 10% per year in companies with similar risk/potential return profiles, you would pay $100 / 10% = $1,000.

But if your Discount Rate is 20%, you would pay $100 / 20% = $500.

QUESTION: A company generates $200 of cash flow next year, and its cash flow is expected to grow at 4% per year for the long term.

You could earn 10% per year by investing in other, similar companies. How much would you pay for this company?

ANSWER: Company Value = Cash Flow / , where Cash Flow Growth Rate < Discount Rate.

So, this one becomes: $200 / = $3,333.

QUESTION: What might cause a companys Present Value to increase or decrease?

ANSWER: A companys PV might increase if its expected future cash flows increase, its expected future cash flows start to grow at a faster rate, or the Discount Rate decreases .

The PV might decrease if the opposite happens.

QUESTION: What does the internal rate of return mean?

ANSWER: The IRR is the Discount Rate at which the Net Present Value of an investment, i.e., Present Value of Cash Flows Upfront Price, equals 0.

Walk Me Through Your Resume

Your answer to this question should be brief and highlight any past finance experience you have. This is your chance to mention internships, programs, or previous jobs that are highly relevant to the role. You should also give a quick overview of your education, especially if you had relevant coursework.

Don’t Miss: What Is A Technical Screening For Interviews

Can A Company Have A Negative Book Equity Value

Book equity value is the accounting value of equity derived by subtracting the value of a company’s liabilities from its total assets. It is the total shareholder’s equity, an amount shown as “Total Equity” in the Balance Sheet of the company.

Sample Answer: Yes. If there are large cash dividends or if the company has been operating at a loss for a long time.

A Comprehensive Interview Guide By Wall Street’s Most Sought

- Real questions, continually updated.Our huge list of “must-know” interview questions is continuously updated with real questions from real interviews.

- Unlike other interview guides, the Red Book has been compiled by former practitioners who train at top financial institutions and business schools. This guide was built with input from our clients the world’s top financial institutions and business schools to ensure each question reflects what interviewees should expect to face and the level of detail interviewers want to hear.

Recommended Reading: What Can You Ask In An Interview

What Is The Difference Between Cash

Sample Answer:Cash-based accounting recognizes sales and expenses when cash flows in and out of the company.

Accrual-based accounting recognizes revenues and expenses as they are incurred regardless of whether cash flows in or out of the company at that exact time.

Accrual-based accounting is the more common method for large corporations.

What Are The Main Factors That Cause A Need For Mergers And Acquisitions

The major factors that lead to a merger and acquisition include:

- Improving financial health and overall metrics

- Eliminating competition from the market

- Gaining more power over pricing by buying out a distributor or supplier

- Diversifying or specializing expanding the companys product or finding ways to make it more niche for a specific market

- Expansion of technological abilities, or absorbing new technologies from acquired companies

Recommended Reading: How To Crack Amazon Sql Interview

Investment Banking Fit Questions

In the fit category, bankers will ask questions about your strengths and weakness, your ability to work in and lead teams, and how much you know about the group and firm.

All questions that are not related to your story, deal/market/company discussions, and technical concepts are in this category.

Rather than trying to memorize hundreds of prepared answers, we recommend following the advice in our article on Investment Banking Fit Questions.

In short, you should prepare 3 short stories to answer most of these questions, select 3 strengths and 3 weaknesses, and then prepare to address your top 3 real weaknesses in interviews.

Discuss Risks That You Have Taken If Your Life

As an Investment Banker most of the time you should take tough decisions. Before taking decision you need to account political changes and the market trends. Therefore, you need to show your ability to take calculated risks and demonstrate adequate analytical skills.

Here, you also need to highlight the logical assumptions made by you while taking any risky decision. Investment Banking is more about roughly right instead of precisely accurate.

You May Like: Job Interview Activities For Students

Ib Interview First Impressions

We’ve all heard about it at one point or another. Forbes has on it.“First impressions are the best impressions.”

Within just a few seconds of meeting, people will form a solid opinion of who you are. Perfecting your first impression while carrying yourself with a healthy balance of confidence and humility lays the foundation and tone for the rest of the interview. The following section has been written by Patrick Curtis, CEO of WallStreetOasis, based on his vast experience of interviewing candidates for investment banking positions.

Read it over, perfect your entry and learn how to leave a lasting impression on your interviewer from the get-go.

All Else Equal Should The Wacc Be Higher For A Company With A $100 Million Market Cap Or A Company With A $100 Billion Market Cap

Sample Answer 1:Normally, the larger company will be considered “safer” and therefore will have a lower WACC all else being equal. However, depending upon their respective capital structures, the larger company could also have a higher WACC.

Sample Answer 2:Without knowing more information about the companies, it is impossible to say. If the capital structures are the same, then the larger company should be less risky and therefore have a lower WACC. However, if the larger company has a lot of high-interest debt, it could have a higher WACC.

You May Like: Aws Cloud Infrastructure Architect Interview Questions

Module : How To Tell Your Story

In this module, youll learn how to answer the most important question in any interview: Tell me about yourself or Walk me through your resume/CV or Why are you here today?

If you answer this question effectively, all the other fit questions will be easy because you can keep referencing your story to answer those questions.

If you dont answer this question effectively, the rest of the interview is pointless because the interviewer will stop paying attention after 1-2 minutes.

- 1 Written Guide: How to Tell Your Story in Interviews.

- 4 Slide Presentations and 4 Videos: Overall Strategy, Undergrads and Recent Grads, Experienced Professionals and MBA-Level Candidates, and IB Exit Opportunities.

- 5 Templates and Executed Examples for Undergrads and Recent Grads: Engineer to IB, Liberal Arts to IB, Mixed Finance to IB, Previous Banking Experience to IB, and Consulting to IB.

- 8 Templates and Executed Examples for MBA-Level Candidates and Career Changers: Big 4 and Accounting to IB, Corporate Finance to IB, Experienced Executive to IB, Law to IB, Back and Middle Office to IB, Military to IB, Equity Research or Sales & Trading to IB, and Entrepreneurship to IB.

- 5 Templates and Executed Examples for IB Exit Opportunities: IB to Private Equity, IB to Hedge Funds, IB to Venture Capital, IB to Other Groups, and IB to Other Banks.

How/why Do You Lever Or Unlever Beta

Sample Answer:Unlevering beta allows us to remove the effect of debt in the capital structure. This shows us the beta of the firm’s equity had it not used any leverage in its capital structure. Also, if we are trying to do a market comparison with a company that’s not on the market , you can take a comparable company and unlever its beta and use this unlevered beta as a proxy for the unlisted company’s beta.

Also Check: How To Analyse Qualitative Data From An Interview

Tell Me About Financial Statements And Why They Are Important

The three common financial statements are balance sheets, income statements, and cash flow statements.

- Balance sheets show a companys assets and liabilities, including shareholder equity, debt, and accounts payable.

- The income statement displays the companys net income over a period of time and shows revenue and expenses.

- Cash flow statements show a companys cash flow from operating, financing, and investing activities.

Walk Me Through A Dcf

In an interview, it is important to keep your technical overview at a high level. Start with a high-level overview and be ready to provide more detail upon request.

Sample Answer:

- Project out cash flows for 5 – 10 years depending on the stability of the company

- Discount these cash flows to account for the time value of money

- Determine the terminal value of the company – assuming that the company does not stop operating after the projection window

- Discount the terminal value to account for the time value of money

- Sum the discounted values to find an enterprise value

- Subtract the present value of debt and then divide by diluted shares outstanding to find an intrinsic share price

Common questions that follow this are:

Why do you multiply by ?

Sample Answer:You do this because interest expense is tax-deductible so you need to account for the benefit provided by this “debt tax shield.”

What is the cost of equity?

Sample Answer:The cost of equity is usually calculated using the Capital Asset Pricing Model .CAPM = Risk-free rate + Beta *

What is the exit multiple method for determining the terminal value?

Sample Answer:Find an industry average multiple and multiply it by final year revenue or final year EBITDA .

Recommended Reading: What Makes A Good Manager Interview Question