Go Beyond Question Lists Using Interview Simulators

With interview simulators, you can take realistic mock interviews on your own, from anywhere.

My Interview Practice offers a simulator that generates unique questions each time you practice, so youll never see whats coming. There are questions for over 120 job titles, and each question is curated by actual industry professionals. You can take as many interviews as you need to, in order to build confidence.

| List of |

|---|

How Do You Assess The Financial Situation Of Your Clients

This is one of the most important aspects of your profession. The first action you will take when you meet a potential new client is to analyze his financial status and determine the most appropriate strategy for the situation.

The recruiters want to make sure that you have an effective method that will give you a broad overview of the needs of your client. Moreover, you have to show flexibility in your judgment. Not every client is the same, and according to the market youre targeting, your approach could be different.

What Kind Of Strategies And Mindset Is Required For This Role

Through this question, the recruiter wants to know whether you have that ideal mindset and strategies for this job. So, handle this question tactfully, showcase the strategies and mindset you have acquired through several years of job experience.

Sample Answer

As a financial advisor, my primary strategy involves multitasking, as the role demands it. Secondly, I would study the financial health of this company, including savings, investments, budgeting, taxes, and more. My main focus is on market research, so I can assist this company on investments for maximizing the profit.

Recommended Reading: Interview Questions To Ask A Cfo

What Is Your Investment Philosophy/approach

Just as youd want to understand the approach of someone counseling you about how to run a business or strengthen your marriage, you should also be familiar with the approach of the person advising you about investments. How do they select the specific investments in your account? Do they use individual stocks or mutual funds? How often do they rebalance or change your accounts? These are all important questions to answer to make sure you know who is making the investment decisions with your nest egg.

Developing An Interview Process

There are a lot of questions here and you may not want to ask all of them or it may be a half-day meeting. Pick some questions that are important to you and type them out in a format where you can take notes. Take this document into the interview and let the advisor know you have some questions and take notes as the advisor answers them. As soon as you are done the meeting, take a moment in private to rate how the advisor did with each of the questions. I like to use a scale of 1 to 10. Its important to do this right away when you get to your car because everything will still be fresh in your head.

Once you have interviewed 2 or 3 advisors, you can now use these documents to compare them. Here are the three most important questions of all:

- Can you see developing a long term relationship with this advisor?

- Do you trust this advisor?

- Can this advisor fulfill your financial needs over the next 5 to 10 years?

Can you think of other questions that are important to ask financial advisors before you hire them?

Jim Yih is a Fee Only Advisor, Best Selling Author, and Financial Speaker on wealth, retirement and personal finance. Currently, Jim specializes in putting Financial Education programs into the workplace.

For more information you can follow him on Twitter or visit his other websites JimYih.com and Clearpoint Benefit Solutions.

Also Check: System Design Interview Preparation

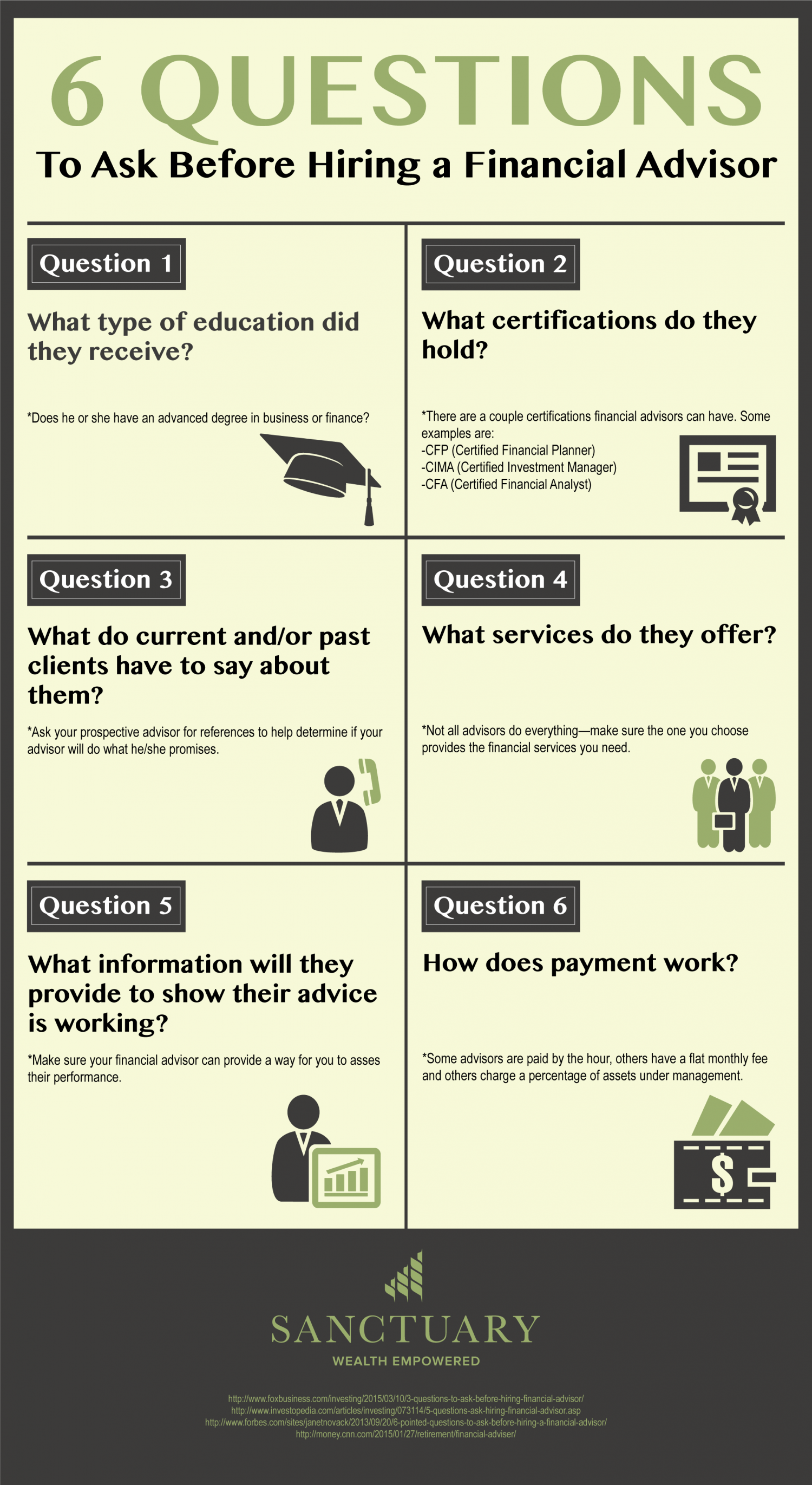

How Much Do You Typically Charge

While the amount you pay the planner will depend on your particular needs, the financial planner should be able to provide you with an estimate of possible costs based on the work to be performed. Such costs would include the planner’s hourly rates or flat fees or the percentage s/he would receive as commission on products you may purchase as part of the financial planning recommendations.

Describe Briefly About Your Experience

Here, the recruiter wants to know about your work experience so far. So, describe all your past work experiences and various companies you have worked with.

Sample Answer

My professional career started during my MBA. I performed the role of a financial advisor for a start-up company as a part-timer. After completing my MBA, I started working as a junior financial advisor for a company called Web Fresh. I worked there for two years. Then I switched to my next company called Eon. There, I worked for three years as a senior financial advisor.

You May Like: Questions To Ask The Cfo In An Interview

What To Ask A Potential Financial Planner

When you are searching for a financial advisor, what you are looking for is a Chief Financial Officer to help you run your familys financial affairs. Youll want to interview several potential candidates and make sure you find the right person for the job. Your interview will involve asking the financial advisor questions.

You can ask about credentials and experience, but since you are hiring someone that has expertise that you dont have, it can be difficult to determine if they are just a good talker, or if they genuinely have the right qualities for the job.

To help you see through the sales talk, weve compiled a list of five practical interview questions. The questions are designed so that you can use the answers to determine qualities like integrity and communication skills qualities every good financial advisor should have.

You can ask these questions over the phone in about 15 minutes, and thus use them to help you pre-screen potential financial advisors, or you can ask them face-to-face.

Questions To Regularly Ask Your Financial Advisor

Maybe you have a financial advisor you enjoy working withthats great! But even so, its important to meet regularly to talk about how your investments are performing and make any changes that are needed.

When you meet for your regular check-in with your financial advisor, consider asking these questions. They can help you know if your wealth-building strategy is on track.

Also Check: What Should Females Wear To A Job Interview

Question #: What Advisory Certifications Do You Have

A financial advisors certifications can be a good indicator of his or her level of experience and expertise. Two of the most notable designations are the certified financial planner and chartered financial consultant . Both require an advisor to have a certain level of experience, complete coursework, submit to a background check and abide by a set of ethical standards.

Certifications can also indicate an area of specialization, which may make an advisor better equipped to serve your particular set of needs. Advisors with tax expertise have designations such as a certified public accountant or a personal financial specialist , which are CPAs who also offer more comprehensive planning. Advisors with insurance expertise may hold a chartered life underwriter designation. Of course, not all certifications carry equal weight as some are much easier to earn than others.

Be sure to take a look over SmartAssets complete overview of the most popular financial certifications. In addition to these, ask how many years of experience each financial advisor has. Like any field, experience matters greatly, especially when theyve invested through varying market conditions.

Questions For A Potential Financial Adviser

Grill prospective advisers before giving them a penny of your business.

After just a couple of meetings, a professional adviser gave me suggestions that increased my savings many fold in the following 40 years.

I thought I knew all I had to know after listening to professionals who gave free presentations thinly disguised events to sell their services or products. On the other hand, the few hours with a Certified Financial Planner revised my thoughts on investments dramatically. He got a flat fee and would make nothing from my investments. He also gave good advice on insurance and estate planning.

Finding a good financial adviser

How to prepare for a meltup or meltdown

It isnt easy to find a truly low-cost, competent and honest financial adviser. People usually ask friends or business associates who they use. Some use a CFP others use a broker, insurance sales person, or tax accountant. People usually like their adviser, but often for the wrong reasons. Their advisers may have great personalities, can be very attentive and always remember their birthdays. However, they may put their clients into high cost investments that benefit the adviser more than the client. Unfortunately, clients aren’t aware of this.

Personal questions

1. How old are you?

If you are older, you may want a younger adviser who will outlive you. If you are young, you may want an older adviser who has been through difficult economic times.

2. What is your educational background?

Read Also: Cfo Interview

How Will We Work Together

Before you commit to an advisor after the first meeting, you should know their process for interacting and engaging with clients.

This is a chance for you to learn more about their process, systems, communication style, and overall business operations. A few additional questions you can ask are:

-

What will be covered during our personal financial planning meetings? Will you help me with budgeting? With retirement planning? Tax planning?

-

How does the financial planning process work?

-

Can you put your financial services in writing?

-

How often will we meet?

-

How often will you reach out to me?

These questions will help you understand how your financial advisor will work with you and if that system is good for you.

-

Are they able to meet virtually?

-

Are they flexible in terms of changing needs, goals, and priorities?

-

How do they set up your financial plan?

-

Is your plan comprehensive?

There are so many valuable insights you can glean by knowing the right questions to ask a financial advisor in the first meeting.

Who Do You Work For Are You Considered An Independent Financial Advisor Or Do You Report To A Branch Manager Or Someone Else

Financial advisors can work in a number of different professionalareas. Some might be at your local bank while others might have an office at atraditional brokerage firm. There are also financial advisors that work forthemselves and use a particular brokerage firm to clear investments through andsome that work directly for a broker.

There might even be some other professionals licensed to sellinvestment products. This could be something like your accountant or yourinsurance company.

Banks

Financial advisors at banks are generally something you wantto avoid. The quality of most advisors located at banks is typically not veryhigh. They are there to hopefully retain the money a person has with the bankby selling investment products and adding to the revenue. The reality is thatmost really good financial advisors can make much more money on their own orwith a traditional brokerage firm compared to being in a bank. There areexceptions to just about everything, but you will almost always not find a veryseasoned and financially successful financial advisor in a bank. It is best toavoid a bank for finding your financial professional.

Brokerage Firm

Insurance Company

Accountant and Additional Professionals

Unless you find a financial advisor that works for a largefirm that has accountants, lawyers and financial advisors all in the sameoffice, it is best to not hire your accountant. If your account works in thesame firm as a full-time financial professional, this might be okay.

Also Check: Mailscoop Io

How Do You View Your Investment Philosophy

Advisors have different beliefs on how to invest your money to earn a return. Some advisors prefer to have their clients invest in low-cost index funds, a strategy that has proven very successful.

Others claim to try to beat the market by picking individual stocks.

Its essential to select an advisor with an investment philosophy you believe in.

Be careful, though. Never work with an advisor that presents an investment philosophy that guarantees returns or that claims they have a track record of beating the markets over the long term. Returns are rarely ever guaranteed, except for a few financial products. Reliably beating the stock market is an extremely difficult feat, as well.

Do You Have Experience Working With Clients Like Us

Every clients situation is unique. However, individual financial advisors often work with clientele who have similar situations and needs. If youre a widow or servicemember, you may not want to hire a financial advisor who works almost exclusively with couples who are in their 60s and almost ready to retire. That advisor just might not have the same level of expertise or experience in the specific financial situations you face.

When looking for a financial advisor, be sure to ask questions about their experience, the types of clients they work with, and where you fit in terms of their client list. Theres no guaranteed way to verify that a prospective financial advisor has the expertise and experience you need. However, during the initial conversation you should ask questions that are specific to your situation. Any prospective financial advisor should be prepared to answer any questions you have on the subjects that matter to you, whether its estate planning, college savings, or handling company stock options. Dont settle for general answers. Ask them how they have helped other clients in your situation and listen carefully to what they say.

Read Also: Top 10 Behavioral Questions

Are You Regulated By Any Organization

Financial planners who sell financial products such as securities and insurance or who provide investment advice must be regulated by provincial regulatory authorities. They may also subscribe to a code of ethics through a professional association. Others who are members of the accounting and legal professions are usually members of professional bodies that govern their fields. Planners who hold the CFP credential are subject to internationally recognized professional standards of competence, ethics and practice that are set and enforced in Canada by FP Canada.

It is a fair question to ask if a prospective financial planner has ever been the subject of disciplinary action by any regulatory body or industry association. You can verify the answer by contacting the relevant organization. Ask the financial planner whether s/he subscribes to a professional code of ethics such as the FP Canada Code of Ethics for CFP professionals.

Describe A Time When You Failed In This Role And The Lesson You Learnt

This is easily one of the important questions you might face. Here, the recruiter tactfully checks your credibility for this job and how you perceive failure in general. So, handle this one thoughtfully and showcase the positive side more than the negative side.

Sample Answer

In my last job, I accidentally miscalculated the investment plan for which the company faced a substantial amount of loss. The company was about to fire me, but thankfully the directors changed their minds and gave me a second chance. I learned the importance of studying the market thoroughly before making the final decision.

You May Like: Best Interview Clothes For A Woman

Why Do You Want To Work With Me What Do You Believe Would Make Me A Good Client

Listen closely to the answers of this question. If an advisor only has all positive things to say and sounds so excited, be a little hesitant. No client of a financial advisor is perfect. Hopefully, the advisor will provide the answers that fit your situation.

You want to also know the typical background of your advisors clients. If they are all doctors and lawyers and you dont fit this mold, you might want to know why the advisor wants you as a client.

Questions To Ask A Financial Advisor

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks or securities.

Before you commit to a financial advisor, you want to make sure youre hiring the best person for you and your situation. Start by asking yourself a key question, then check out the 10 questions you should ask an advisor before hiring one.

Don’t Miss: Women’s Outfit For Job Interview

What Are Your Credentials

When you ask this question, you dont want to hear anything along the lines of, I specialize in retirement accounts. You need a more specific answer. When it comes to a financial advisor, credentials matter. Those fancy letters after the advisors name prove that they have dedicated a lot of time to mastering their profession.

Ideally, your financial advisor would be a CFA , CFP® , or PFS . If you have certain financial needs, you might look for a more specialized credential, such as a CDFA® .

Are You Comfortable Reaching Out To Clients In Person And Over The Phone

Financial advisors must know how to interact and hold productive conversations with clients. By asking this question, you can learn more about a candidate’s communication skills and related qualities. What to look for in an answer:

- Experience interacting with clients

- Excellent interpersonal and communication skills

- Excitement about reaching out to clients

Example:

“Contacting clients is a task I am always happy to carry out. Before I became a financial advisor, I was a marketing representative. My experience helped me develop excellent communication and interpersonal skills. I believe I am ready to use those skills as a financial advisor in your organization.”

You May Like: Interview With Cfo