Self Employed Car Loans: Good Credit Vs Bad Credit

Like all auto loans, credit plays a huge part in whether or not you qualify, as well as what terms you qualify for. In the eyes of auto loan lenders, there are only two types of self-employed car buyers: Those with good credit and those with bad credit. If your credit is in good standing, then you probably won’t have much trouble qualifying for a car loan.

However, if you have bad credit, you may be required to present some additional paperwork in order to prove your income. This is where some self-employed car buyers get into a bit of a pickle. By racking up your deductions, you lower your taxable income and keep more money in your pocket at tax time. However, this low reported income could also cause you to not qualify for an auto loan.

It’s important to report your income accurately in order to keep your credit in good standing. If your credit appears to be bad, learn how to increase your score here.

How Do You Handle Pressure Or Stressful Situations

They also want to know whether you can hold the fort or crumble under pressure. A perfect answer is to briefly tell a story where you remained calm under pressure. If you dont have work experience yet, share your experience on how you handle school events gracefully despite the pressure.

Working under pressure has taught me how to prioritize and balance my workload, which I believe is a good thing. I once had four very important tasks due in the same week, but I was able to complete all assignments on time because I meticulously organized and planned how would I approach each project. I was able to avoid stress entirely due to my planning and prioritization skills.

Question : Do I Need To Get Gap Insurance From The Dealer

There are benefits to having GAP coverage for your new vehicle. WEOKIE offersGAP Advantage as an option for our auto loans, and it comes with many great offers.

When you are getting a new vehicle from the dealer, they may try to push GAP coverage when you buy. GAP insurance is best for borrowers on long-term loans with low down payments. If it takes a few years to get out from underneath a loan, it can be beneficial.

Before you agree to get GAP insurance through the dealer, find out if there are better options elsewhere. You may be covered by your insurance, or it can be an inexpensive add-on for a new or existing policy. Some companies specialize in GAP coverage and offer it at a much lower rate than the dealer.

If you are paying a hefty down payment and wont be upside down on your loan for very long, you may not need to spend the extra money on GAP. Instead, throw that additional money at the monthly payments.

Read Also: What Is The Star Method Of Answering Interview Questions

To Proceed The Following Should Be Handy

- Operational Mobile number Registered with Aadhar No

- Valid E mail ID

- Internet, Camera/Webcam & Microphone enabled Mobile/Device

- Enable browser Location of the device used for Account opening. and allow when prompted.

- This Account can be opened by Resident Indian Individuals aged 18 years and above.

- This facility is for customers who do not have account with Bank.

- You should be in a well-lit area with good network

What Is Home Equity Loan

Home equity loan, also known as the second mortgage, enables you to borrow money against the value of equity in your home. For example, if the value of the home is $1, 50,000 and you have paid $50,000. The balance owed on your mortgage is $1, 00,000. The amount $50,000 is an equity, which is the difference of the actual value of the home and what you owe to the bank. Based on equity the lender will give you a loan.

Usually, the applicant will get 85% of the loan on its equity, considering your income and credit score. In this case, you will get 85% of $50,000, which is $42,500.

Don’t Miss: Interview Question For Accounts Payable Position

Where Do You See Yourself Five Years From Now

Answer your professional goals and align them with the job youre applying for. Focus on the skills you want to learn and improve at. Avoid saying, I see myself having a family, traveling the world, etc. This is your opportunity to showcase your career goals and highlight your ambitions.

In 5 years, I would like to have proven that I have the drive and determination to help the company grow. My goal is to develop leadership skills and someday handle people in this company.

What Do You Mean By Foreign Draft

Foreign draft is an alternative to foreign currency it is generally used to send money to a foreign country. It can be purchased from the commercial banks, and they will charge according to their banks rules and norms. People opt for foreign draft for sending money as this method of sending money is cheaper and safer. It also enables receiver to access the funds quicker than a cheque or cash transfer.

Also Check: Do You Have Any Questions Interview

What Are The Types Of Accounts In Banks

a) Checking Account: You can access the account as the saving account but, unlike saving account, you cannot earn interest on this account. The benefit of this account is that there is no limit for withdrawal.

b) Saving Account: You can save your money in such account and also earn interest on it. The number of withdrawal is limited and need to maintain the minimum amount of balance in the account to remain active.

c) Money Market Account: This account gives benefits of both saving and checking accounts. You can withdraw the amount and yet you can earn higher interest on it. This account can be opened with a minimum balance.

d) CD Account: In such account you have to deposit your money for the fixed period of time , and you will earn the interest on it. The rate of interest is decided by the bank, and you cannot withdraw the funds until the fixed period expires.

How Do You Work To Reduce Errors In Your Work

Attention to detail is an important skill for loan processors. They must review all data carefully and input information to ensure a client’s borrowing information is correct. An interview may ask this question to evaluate your detail-orientation skills and your work ethic. To answer, consider your overall work process and how you review data. After briefly describing your overall process, you can provide a specific example of how you caught an error.

Example:”I created a review system to help reduce errors in the mortgage process. I use loan processing software that flags any unusual numbers. I also have a phone call with clients to review their numbers. This call helps clients understand their numbers and helps me quickly notice any mistakes before the verification process.

In my last role, this process helped me find a mistake before submitting the loan to the underwriter. My client had made a typing mistake when inputting their data in the software. When reviewing the information over the phone, I was able to check with the client and quickly correct the mistake.”

Don’t Miss: What Will They Ask You In A Job Interview

How Do Banks Calculate Interest Rates On Car Loans

Interest rates for car loans provided by public and private sector banks in India might be either fixed or floating. A fixed rate of interest on loans is fixed for the overall duration of the loan. With a floating rate, the ROI on your easy equated monthly installment is calculated as per the base lending rate plus the standard premium rate, and lenders repo-linked loan rate or marginal cost of fund-based lending rate .

The ROI on car loans for every bank changes as per the RBIs change in repo rate . In the floating rate, the change is, however, reflected after the reset period when the interest rate on your EMI is subjected to revisions. Nonetheless, banks usually provide the breakdown of EMI against the outstanding amount in your car loan sanction letter.

For a borrower applying for a new car loan of INR 10 lakh with an RoI of 10.5% for a tenure up to 10 years, the formula of simple interest will be used to calculate the interest on that sum to calculate your monthly EMI.

The procedure is as follows:

E = P X R X N/N1)

Where, E = EMI P = Principal amount R = Rate of interest N = Tenure in months.

EMI = INR 10,00,000 X 0.00875 X 120 / 120 1) = INR 13,493.

What Are The Different Types Of Fixed Deposits

There are two different types of Fixed Deposits

Special Term Deposits: In this type of Fixed Deposits, the earned interest on the deposit is added to the principal amount and compounded quarterly. This amount is accumulated and repaid with the principal amount on maturity of the deposit.

Ordinary Term Deposits: In this type of Fixed Deposits, the earned credit is credited to the investors account, once in a quarter. In some cases, interest may be credited on a monthly basis.

The earned interest on fixed deposits is non-taxable. You can also take a loan against your fixed deposit.

Recommended Reading: How To Do A Successful Interview

What Is Line Of Credit

Line of credit is an agreement or arrangement between the bank and a borrower, to provide a certain amount of loans on borrowers demand. The borrower can withdraw the amount at any moment of time and pay the interest only on the amount withdrawn. For example, if you have $5000 line of credit, you can withdraw the full amount or any amount less than $5000 and only pay the interest for the amount withdrawn .

What Else Is Needed For A Car Loan

Proving your income isn’t the only requirement when applying for an auto loan. Depending on the lender, they may ask you for other types of information as well. Most of this is required so that the lender can contact you should there be an issue with repayment. For example, you’ll probably be asked to produce a proof of residence. They may also want your landlord’s information or your most recent mortgage statement.

It’s not uncommon for lenders to ask for personal references also. This is a list of close family and relatives along with their addresses. You might also be asked for a copy of your most recent phone bill. Finally, some institutions will even call you for a personal interview.

While this might seem like a lot, it’s important to keep in mind that not all lenders require the same information and not all self-employed car buyers will be asked for the same documents. Your ability to qualify for a loan is largely dependent on your credit history and your ability to prove steady income.

Read Also: How To Bring A Resume To An Interview

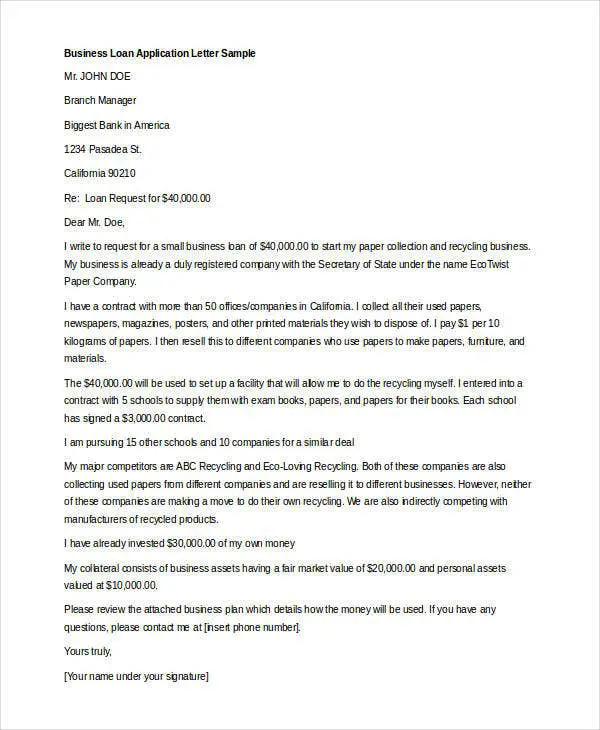

Bank Business Loan Vs Non

Bank loans

Banks are the more traditional choice for loans and can be a good option for those who want familiarity, but theyre not always right for every business. They offer the meat and potatoes of business loans: term loans, lines of credit, equipment and commercial loans and not much else.

Their eligibility is also stricter than other options, and theyve only tightened their requirements since online lenders have come to the scene. Interviews are one of the ways they make absolutely certain theyre not taking too much of a risk by giving your business money.

Five Questions To Ask Before Accepting An Auto Loan

Finding the right new car loan is all about asking the right questions.1. What Is Your Credit Score?2. How Will Your Credit Score Impact the Terms of Your Loan?3. What Is the Interest Rate on the Loan?

- How often is the interest rate compounded? An annual interest rate of 5% compounded daily has a far different impact than an identical auto loan rate that’s compounded once per year.

- How is the interest on the loan amortized over time? Are the first few year’s payments devoted solely to the interest, or are you able to pay off some principal as well?

- Does the interest rate change if you miss a payment? Some lenders will try to sneak in terms that raise the interest to the maximum legal amount if you miss even a single payment on a new car loan.

Understanding the repayment structure of your new car loan is the mark of a truly educated consumer, so take the time to go over the details before you sign on the dotted line. Whether you have an A+ credit score or an average one, its important to shop around for the loan that works for you. Before you accept any form of car financing, you always want to make sure that you know exactly what you’re getting into.If you have additional questions on selecting the best auto loan for you, Truliant Federal Credit Union can help. We will help you understand your credit, review loan options and go through everything with you from rate to the fine print. Schedule an appointment to discuss a credit union auto loan.

Related Topics

Also Check: What Are The Common Questions In A Job Interview

How Long Should I Pay The Loan

When it comes to any kind of loan, its important to be aware of the terms of the deal. You need to know how long it will take before you can completely pay it off. Also, its important to note that the longer the term, the higher the interest rate. It means more money for you to spend. If you can have the loan paid in fewer years, do it that way so you wont incur higher fees. It is always best to get everything paid as early as possible.

What Do You Mean By Term Loan Maturity And Yield

The date on which the principal amount of a loan becomes due and payable is known as Loan Maturity. Yield is commonly referred as the dividend, interest or return the investor receives from a security like stock or bond, interest on fix deposit etc. For example, any investment for $10,000 at interest rate of 4.25%, will give you a yield of $425.

You May Like: How To Have Good Interview Skills

Auto Loan Interview Questions Glassdoor

- www.glassdoor.com

- Highest rating: 3

- Lowest rating: 2

- Descriptions: Tell me about yourself? Why would you be a good candidate for this position? Give us a typical day at your last position? How well do you take rejection?

- More : Tell me about yourself? Why would you be a good candidate for this position? Give us a typical day at your last position? How well do you take rejection?

- https://www.glassdoor.com/Interview/auto-loan-interview-questions-SRCH_KO0,9.htm

What Is The Process For A Car Loan Approval

The usual process to obtain a car loan includes the following:

You May Like: How To Prepare For Nursing School Interview

What Are The Types Of Commercial Banks

Following are the types of Commercial Banks

a) Retail or consumer banking

It is a small to mid-sized branch that directly deals with consumers transaction rather than corporate or other banks

b) Corporate or business banking

Corporate banking deals with cash management, underwriting, financing and issuing of stocks and bonds

c) Securities and Investment banking

Investment banking manages portfolios of financial assets, commodity and currency, fixed income, corporate finance, corporate advisory services for mergers and acquisitions, debt and equity writing etc.

d) Non-traditional options

There are many non-bank entities that offer financial services like that of the bank. The entities include credit card companies, credit card report agencies and credit card issuers

Ad Compare The Best Auto Loans

. Follow these three easy research tips before your next job interview. Bank of America Best Bank for Auto Loans. You might be able to read online about other peoples interview.

Auto Loan Funding Analyst was asked. How do you define. The name comes from adding up all the numbers in the year and then applying.

No minimum or maximum. Consumers Credit Union Best Credit Union for Auto Loans. Tell me a bit about yourself.

What is your worst character trait. September 27 2014 Describe a time you had to make chages to a planschedule how you did so and what was the end result. Top 50 Banking Interview Questions Answers 2022 Update 1 What is bank.

The rule of 78 is one of the main tactics and the basis for precomputed interest auto loans. You can apply for a loan by calling our customer call center 1800 1200. Ad Get Pre-Approved To See Your Real Terms For Every Vehicle.

During your interview process test candidates for. The average interest rate on a new car loan was 382 for the best credit scorers while those with the lowest credit scores carried new car loans with 1425 interest rates on. 7500 12 to 75 months.

Free interview details posted anonymously by Hong Leong Bank interview candidates. HDFC Bank Interview Questions and Answers for Teller Before we begin lets review the job description and find the skills and experience required to do the job. Banks may be able to revoke your car loan if your contract had language that protects the banks right to do so.

Lettersformats

Also Check: Where To Stream Interview With The Vampire