Meeting With A Counselor Requirement

All entering students receiving any type of federally funded student aid for the first time at WesternU will be required to meet with a Financial Aid Counselor. The time and the date will be announced via your WesternU email. Students are always welcome to walk into the Financial Aid Office during regular business hours to speak to a financial aid professional, no appointments are necessary. .

Entrance And Exit Interviews

Required For Federal Loans

All students whose financial aid packages include federal loans are required to complete:

- an Entrance Interview before the disbursement of their loans, and

- an Exit Interview prior to leaving the University.

Your school may require you to attend these interviews in person. Please check additional requirements with your School Financial Aid Office.

What Is An Exit Interview

Federal regulations require that student loan borrowers complete a counseling session within 30 days of leaving school or dropping below half-time status It is information that informs you of your rights and responsibilities in repaying the loan. To complete an Exit Interview, visit www.hofstra.edu/FAExit .*REQUIRED FOR DEGREE

Also Check: How To Start An Interview As The Interviewer Example

The Federal Direct Additional Unsubsidized Loan For Independent Students

What: Offered through the Department of Education to the independent undergraduate or graduate/professional students as an additional source of funds.

How much: Students may borrow amounts up to $6000 as a freshman or sophomore, $7000 as a junior or senior, or $12,000 as a graduate student.

Interest: Varies

Requirements: Students must be enrolled for and complete at least 6 credit hours. The applicant’s eligibility for Federal grants and the Federal Direct Stafford loan must be determined before this type of loan can be awarded. If a dependent student’s parent is denied a Direct PLUS loan the student may be eligible for funds under the Federal Directloan program however, a Direct PLUS loan denial letter from the Department will be required.

Repayment: Interest is accrued once the loan is disbursed and repayment begins after termination of enrollment.

Student Loan Exit Counseling

While student loan entrance counseling provides students with a general overview of the concepts and terms related to student as well as advice to consider when taking out student loans, student loan exit counseling is focused on making sure that students understand the responsibilities that they will take on when they drop below half-time enrollment, leave school, or graduate.

Don’t Miss: How To Perform A Job Interview

What Are Some Key Facts About Repaying Direct And Ffel Direct Loans That I Should Know About

- If you don’t choose a repayment plan when you first begin repayment, you’ll be placed under the Standard Repayment Plan.

- You can change plans to suit your financial circumstances.You’ll get more information about repayment choices before you leave school and, later, from the holder of your loan. You can also get more details about repayment plans at . The chart below shows typical repayment plans for both programs. This chart also shows estimated monthly payments for various loan amounts under each plan and assumes that the student is making regular monthly payments on any unsubsidized loans and is not capitalizing the interest while in school. If the interest is capitalized* , the cumulative payments and total interest charges will be higher than shown in the chart.

|

Examples of Typical Direct and FFEL Direct Loan Repayments |

||

|---|---|---|

|

Estimated Monthly Payments & Total Amounts Repaid Under Different Repayment Plans |

For Direct Loans Only: Income Contingent |

|

|

Initial Debt When you Enter Repayment |

Standard |

Extendeda |

|

$84,352 |

Payments are calculated using the fixed interest rate of 6.8% for student borrowers.

What Are Entrance And Exit Interviews

If you have federal student loans, you will be required to complete an entrance interview prior to receiving a loan and an exit interview before you graduate. Entrance interviews help you understand your student loan responsibilities. Exit interviews are used to inform you about your repayment obligations and options.

Recommended Reading: What Questions Should A Candidate Ask In An Interview

Can I Change My Repayment Schedule

Federal loans offer several repayment options. Repayment schedules for state-based or private student student loans may be limited or may need to be chosen before you borrow, so research your options and choose wisely.

Which option is best for you on your federal loans depends on your individual circumstances.

- Standard/Level – Monthly payments that remain level over the life of the loan.

- Graduated – Payments start lower and increase every 2 years for the life of the loan. Typically, this option will result in greater interest charges over the life of the loan.

- Extended For balances $30,000 or more. Increases the repayment term to up to 25 years, thereby lowering your monthly payment. A longer repayment term means you will pay more in interest charges over the life of the loan.

- Income-Sensitive/Income-Based/Pay-as-you-Earn – Payments are adjusted annually according to income.

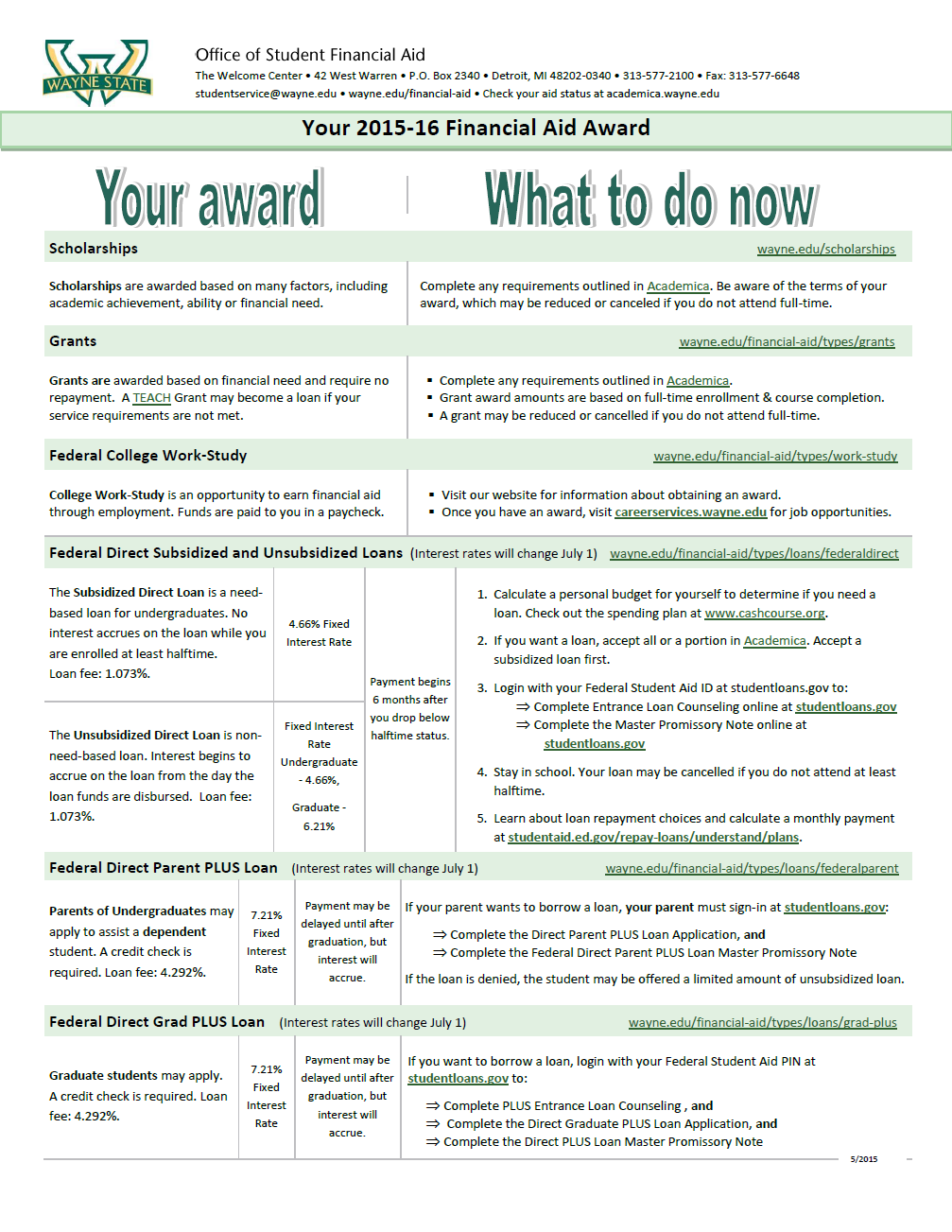

Where Do I Go For Student Loan Entrance Counseling

To complete your entrance counseling you will need to log into the StudentLoans.gov site. According to the site, it will take about 20 to 30 minutes to complete once you get started. You will want to have the following on hand to save time:

- Federal student aid ID

- Financial aid information

- Expected and current living expenses

Some schools will have their own entrance counseling as well, so make sure to check with the financial aid office to be sure you have checked every box.

Also Check: What To Say In A Post Interview Email

Entrance Counseling And Exit Interviews

Federal regulations require all student borrowers to complete entrance and exit loan counseling.

The purposes of these interviews are to explain your rights and responsibilities of borrowing and to remind you of the importance of repaying the funds that have been borrowed.

Entrance counseling is required of all law students who borrow loan funds through the William D. Ford Federal Direct Loan Program and the Federal Direct Graduate PLUS loan program.

Exit counseling is a requirement for everyone who has borrowed funds from a federal and/or private loan program who is either graduating from the law school or is otherwise “separated” from the law school due to withdrawal, academic disqualification, or an approved leave of absence. It is designed to prepare you for repaying your student loans and help you with personal financial management.

Throughout the counseling and interviews you will learn the rules that apply to your student loans, repayment options, debt management possibilities, and the consequences of defaulting on your loans and pertinent information on tracking both your federal and private loans. Graduating students will receive information on completing their exit interviews a month and a half prior to graduation.

Fall Graduate Loan Proration Policy For Undergraduates

STUDENTS GRADUATING IN A FALL TERM

Under 34 CFR 685.203,,, federal regulations require schools to prorate the Federal Direct Stafford Loan amount for graduating undergraduate students when their final period of enrollment is less than a full academic year. Graduating seniors who are only attending one semester of the academic year may have their Federal Direct Stafford Loans prorated based on the number of credit hours remaining in their program of study.

WHAT IS LOAN PRORATION

Loan proration ensures a student receives the correct portion of their annual allotment for Direct Loans, since they will not be enrolled for a full academic year. Students graduating in the Fall semester and enrolled in below 12 hours will have their loans prorated based on the hours they are enrolled in. Students who change their schedule after the loan proration is performed must contact the Office of Student Financial Aid for a re-evaluation of their eligibility.

HOW IS IT CALCULATED?

The formula provided by the federal government is below.

Federal Direct Loan Proration Formula

_____________________________________________ x Annual Direct Loan Limit

Example for Students Enrolled Full-time

Also Check: How To Interview Product Managers

Federal Loans: Entrance Counseling For Direct Loans

The University strives to provide entrance counseling in person prior to the first enrollment, as part of the Universitys registration process. In the case of online students, the entrance counseling at www.StudentLoans.gov is used as an alternative while providing the student with availability of personal contact with the financial aid office for questions or concerns about borrowing Federal Direct Student Loans Subsidized, Unsubsidized, and Graduate PLUS.

These points are reviewed at the Entrance Interview:

Can My Loan Be Forgiven

The federal government will forgive all or a portion of a federal education loan under certain circumstances. In order to qualify, you must be active in the military, performing volunteer work, practice medicine in certain communities, teach in high need areas, or meet other criteria . To learn more about the different types of federal loan forgiveness, visit studentaid.ed.gov. RISLA also offers loan forgiveness and reward programs. Loans may also be forgiveness in the unfortunate circumstance the student passes away. Contact your individual lender for details.

You May Like: How To Prepare For Behavioral Interview

Direct Student Loan Limits

Direct Student Loans have fixed maximums based on your year in school and dependency status. If youre a dependent undergraduate student, each year you can borrow up to:

- $5,500 if youre a first-year student enrolled in a program of study that is at least a full academic year .

- $6,500 if youve completed your first year of study and the remainder of your program is at least a full academic year .

- $7,500 if youve completed two years of study and the remainder of your program is at least a full academic year .

If youre an independent undergraduate student or a dependent student whose parents have applied for but were unable to get a Direct PLUS Loan for Parents, each year you can borrow up to:

- $9,500 if youre a first-year student enrolled in a program of study that is at least a full academic year .

- $10,500 if youve completed your first year of study and the remainder of your program is at least a full academic year .

- $12,500 if youve completed two years of study and the remainder of your program is at least a full academic year . This amount remains unchanged for both academic years.

If you are a graduate student each year you can borrow up to $20,500. Graduate students may not receive Direct Subsidized Loans.

You cannot borrow more than your cost of attendance minus other financial aid including other loans. As a result, the amount you may borrow could be less than the maximums listed above.

What Is A Grace Period

After you leave school, you may be entitled to a period during which you aren’t required to make student loan payments. Although this applies to all federal loans, not all private student loans afford you this option so make sure to check with your lender to determine when you will need to begin making payments on your loans. The RISLA Student Loan has a 6 month grace period after the student leaves school.

You May Like: How To Have Good Interview Skills

Promissory Note & Entrance Counseling

All loans require that you sign a promissory note. This note is signed by the borrower when taking out a loan. By signing the promissory note, the borrower promises to repay the loan. The promissory note also includes important language about your rights and responsibilities as a borrower.

Federal and Cornell University loans require a Master Promissory Note . You sign the MPN once, the first time you borrow. This will allow you to borrow more from the same loan source while you are in school, without having to sign a promissory note each year.

Go to the following links to sign the promissory note electronically for your:

What Happens If I Default On My Student Loan

Defaulting on your student loans has many serious consequences. If you are having trouble making payments, remember to call your student loan lender or servicer to learn about your deferment and forbearance options or to see if you qualify for a different repayment schedule. If you default on a student loan, you may:

- Be ineligible for federal and private student aid in the future.

- Lose your deferment and forbearance options.

- Have to pay your entire loan balance immediately.

- Pay additional costs if your account is turned over to a collection agency or attorneys.

- Hurt your credit and therefore your ability to borrow in the future, rent an apartment, or even get a job.

- Have your federal or state tax return withheld so that it can be applied to your defaulted loan balance.

- Have your wages garnished which means your employer would know you owed money to someone.

Recommended Reading: What To Ask A Babysitter In An Interview

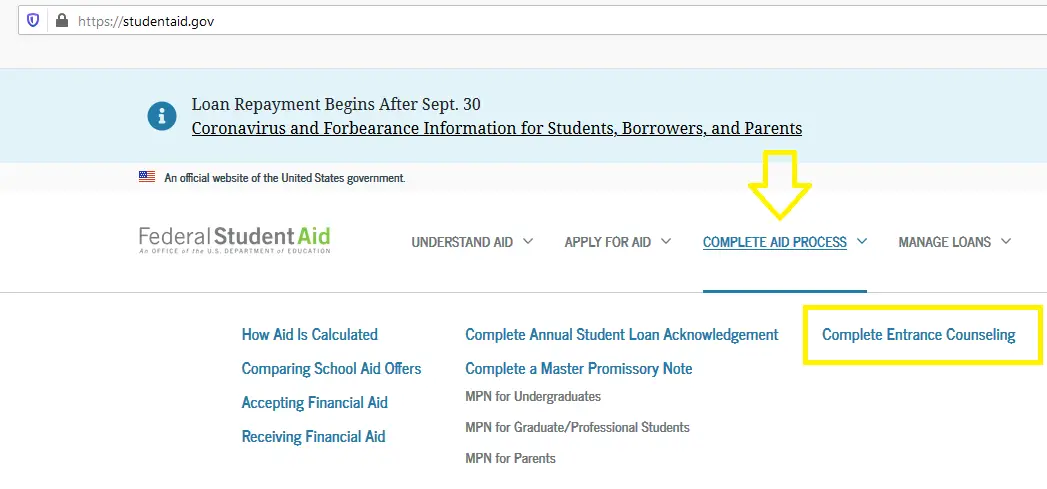

Annual Student Loan Acknowledgement

The Annual Student Loan Acknowledgement is a tool for borrowers who take out federal student loans. If they have loans on file, theyll learn important repayment terms and estimates, how much they have borrowed thus far, and whats available for the remainder of their education. New borrowers must acknowledge other information, such as salary and debt estimates for their chosen program and information about how interest works. This required step is completed on studentaid.gov.

Eligibility Requirements To Receive A Federal Direct Student Loan

Students must be enrolled as a regular student in an eligible, degree seeking program, enrolled at least half-time credit hours, meeting Satisfactory Academic Progress and all other Federal Requirements to be considered for the Federal Direct Student Loan Programs. Regular students may receive aid for classes they take in a schools continuing education department as long as the classes apply to their degree or certification program.

Half-time enrollment consists of:

Undergraduates Six credit hours during Fall or Spring semesters. Three credit hours during a Summer semester.

Graduate Five credit hours during Fall or Spring semesters. Three credit hours during a Summer semester.

According to Federal Regulations: If a student is enrolled in courses that do not count toward his/her degree, they cannot be used to determine enrollment status unless the courses are noncredit or remedial courses*. This means a student cannot be awarded and receive aid for classes that do not count toward his/her degree or certificate.

*Further stipulations regarding non-credit, reduced credits for remedial courses are outline in the Federal Regulations.

Therefore, Graduate students must be enrolled in graduate or eligible graduate classes, as stipulated in the Students Handbook, to receive Federal Student Aid.

Example:

An eligible graduate student is enrolled in 12 credit hours during a spring semester :

Also Check: What Are Some Job Interview Questions

What Is Deferment And Forbearance

Your lender may grant you a temporary postponement of payments called a deferment or forbearance. Whether you receive a deferment or forbearance depends on your eligibility. If you are going to back to school at least half time, you are unemployed, in the military or performing another public service, or having trouble making your student loan payments for any other reason, contact your lender or student loan servicer to see if you qualify for a deferment or forbearance.

Entrance Loan Counseling Requirement

Welcome to Western University of Health Sciences . To be in compliance with Federal regulations, all WesternU students who are planning on paying for their education through the Federal Direct Loan program and Grad PLUS Loan program must complete the Entrance Loan Counseling on line. The purpose of the entrance interview is to provide the student with important information regarding their rights and responsibilities as a student borrower. This requirement also applies to students who have previously borrowed at another institution. Loan funds cannot be released/disbursed until this requirement has been met.

The Entrance Loan counseling may be completed on line by clicking Direct Loan Entrance Counseling , Log in or scroll down to Complete Entrance Loan Counseling, log in with your user ID and FSA ID password, you will then need to select Complete Entrance Counseling from the list, select your school, add school to notify. The on line counseling session will take about 30 minutes to complete, you CANNOT save or try to return to finish the entrance counseling at a later time, it MUST be completed in one step.

Once you have successfully completed the counseling session, an electronic confirmation will be sent to your email. Please print a copy of your confirmation for your records, all exam results will be sent to financial aid electronically. The deadline to complete your Entrance Loan Counseling is June 30, 2021.

Don’t Miss: How To Interview A Person For A Job

The Federal Direct Additional Unsubsidized Loan For Dependent Students

What: Offered through the Department of Education to qualifying dependent, undergraduate students as an additional source of funds.

How much: Qualifying students may borrow amounts up to $2000.00 as a dependent, undergraduate student. The students cannot exceed their Cost of Attendance.

Interest: Varies. This loan accrues interest while the student is enrolled and is the responsibility of the borrower throughout the entire history of the loan. The interest may be paid while attending school or capitalized until the student leaves the university or falls below ½ time enrollment.

Requirements: Students must be enrolled for and complete at least 6 credit hours, in an eligible degree-seeking program. The applicants eligibility for Federal grants and the Federal Stafford loan must be determined before this type of loan can be awarded. All eligibility requirements for Federal Student Aid must be met.

Repayment: Interest is accrued once the loan is disbursed and repayment begins after termination of ½ time enrollment.