Explain What Negative Working Capital Is

Candidates may respond to this question by first explaining what positive working capital is, which is a term that describes the fact that a business can pay off immediate debts thanks to its sufficient liquid assets.

They may then compare this with negative working capital, which is a term that indicates that an enterprise may not be able to pay off immediate debts with its current assets alone.

Explain What Services Rendered Means

Services rendered refers to services that a business offers and fulfills before the client pays for the service. Accounts receivable professionals will record the rendered service and produce an invoice when the service agreement has concluded. They will then present the invoice to the client to get paid.

What Steps Do You Take To Check For Accuracy And Avoid Errors

Accounts receivable clerks need to be meticulous in their work and ensure it’s free of errors. This question’s goal is to assess if the candidate does a thorough job. What to look for in an answer:

- Organizational skills

- Meticulous and committed to producing error-free documents

Example:

“It’s very important to me that my work is free of any errors. I know a slight mistake on a financial statement could cause several issues. To make sure my work is error-free, I take my time and double-check everything before finalizing it. Even if I’m driven by a deadline, I never sacrifice quality for speed. I also find using the right software programs helps me avoid mistakes.”

Don’t Miss: Google Product Manager Interview Questions And Answers

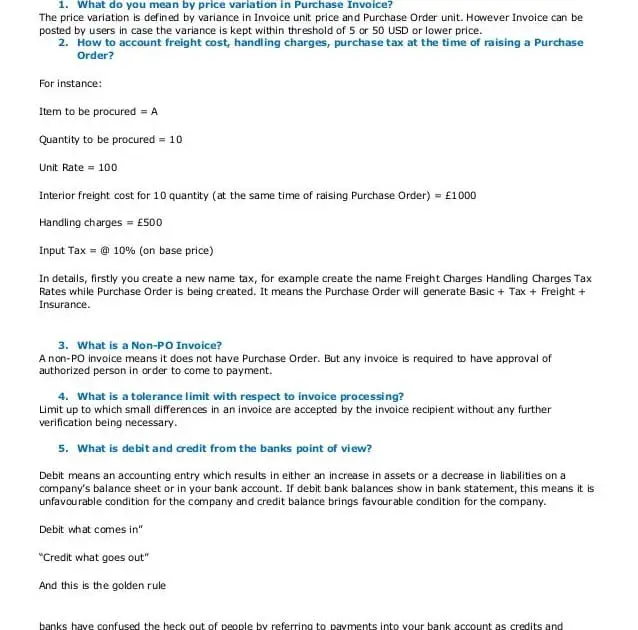

Explain To Me The Term Dso Or Days Outstanding

How to Answer

The interviewer is looking for your level of familiarity with the term DSO or Days Outstanding. DSO or Days Outstanding and is a measure of the average number of days that it takes a company to collect payment after a sale is made. This metric is a significant one in accounts receivable. DSO = Total Accounts Receivable/Total Sales x Number of Days.

Written by Rachelle Enns on January 7th, 2019

Answer Examples Have Been Hidden

Please upgrade to view

Important Accounts Receivable Interview Questions

Detail your responsibilities in accounts receivable.

Discuss all your responsibilities. Focus on the skills and knowledge you used to perform these functions efficiently such as:

- maintaining a high level of accuracy

- good verbal and written communication skills

- strong organizational skills

- printing out relevant reports

What information is included in a bill for services?

List the information, make sure you cover everything and highlight your attention to detail. Include a sample of a bill for service that you created in your interview portfolio.

What was your average accounts receivable days outstanding?

If relevant, discuss any corrective action taken to reduce this figure.

What do you consider the most important goals of accounts receivable?

These goals will depend on the needs of the organization. Show how you are aware of organizational needs and then identify the appropriate goals to meet them.

Demonstrate a thorough understanding of what the goals express and how they support department and company objectives. Common aspects include:

- positively impacting on company cash cycle

- increasing cash flow

- reducing bad debt and write offs

What are your strengths as an accounts receivable professional?

Try to make your strengths relevant to the job requirements. This list of strengths is a useful resource for answering interview questions about your strengths.

Read Also: What Do You Need For Tsa Precheck Interview

What Is Bank Reconciliation

Can your candidates give a precise definition of a bank reconciliation? Do they know that the process involves matching unpaid billings from customers to the total recorded in the general ledger for the accounts receivable?

Candidates should also be able to explain why bank reconciliation is important and may mention that it ensures the accounting records and statements are accurate.

They may also mention that bank reconciliation can help enterprises safeguard against fraudulent activity.

Dont Be Afraid To Close The Deal

Once the interview is over, the likelihood is both you and the interviewer have a good idea of where one another stand. As you stand up post interview and engage in a final handshake, be upfront. Confidence here can go a long way. If you believe you nailed the interview, be bold:Im going to be straight with you – I think that went really well and I think Id be a great asset here. Where do I stand as of now?. Alternatively, if you dont think it went wellyou probably have your answer already.

Don’t Miss: What Are Frequently Asked Questions In A Job Interview

What Kind Of Strategies And Mindset Is Required For This Role Explain With Example

Tip 1: The interviewer wants to know if you have the right attitude to take on this role

Tip 2: Answer this question using a strategy that has helped you better your performance.

Answer: As an Accounts Receivable, one needs to be more attentive and have a keen eye for detail. One should be organized to set defined goals and efficient enough to reach existing customers. This will help the organization be a better place for cashflows and accounts. One needs a calm and peaceful mindset to carry out the regular hectic accounting tasks correctly.

What Information Is Contained In The Accounts Receivable Sub

How to Answer

The interviewer is looking for your basic A/R knowledge as well as your ability to explain a straightforward concept in an easy to understand way. Walk the hiring authority through the information that an A/R sub-ledger would contain. Briefly describe the purpose of an A/R ledger, and why they are essential in accounting.

Written by Rachelle Enns on January 7th, 2019

Answer Examples Have Been Hidden

Please upgrade to view

Don’t Miss: How To Make Money Doing Interviews

Smart Questions To Ask At The End Of Your Accounts Receivable Interview

At the very end of your accounts receivable job interview, the account or hiring manager will say to you:

Thats the end of your interview, do you have any questions for us?

The questions you ask could be the difference between a pass or fail. Avoid questions about time off, holiday entitlement, sick pay, or salary unless specifically asked what are your salary expectations?

Instead, ask three sensible and smart questions that focus on what you can do to help their company thrive. Here are three great questions to ask:

Q1. What advice would you give to the successful candidate who wants to excel in the role?

Q2. Whats the one thing I can do in this role to help your business succeed?

Q3. Can you tell me more about the accounting team I would be a part of?

Questions About Experience And Background

Your hiring manager may ask questions concerning the specifics of the position. Employers look out for knowledgeable applicants who know how to react to specific situations. The following questions may appear in your interview to help assess your current knowledge of accounts receivable clerk responsibilities:

-

What accounting software are you the most familiar with?

-

How does the accounting software you use expedite your tasks?

-

Describe the journal entry process.

-

What information would you include in an invoice for services rendered?

-

What accounting reports do you create daily in this position?

-

Why is a bank reconciliation performed?

-

How often do you conduct bank reconciliation?

-

What information do you use when forecasting next month’s payments?

-

Describe the steps taken to close the accounts receivable period.

-

Upon finding a billing discrepancy, what is the first thing you should check?

Also Check: What Not To Say In A Job Interview

The Skills And Qualities Needed To Work In Accounts Receivable

To work effectively in this role, you will need experience in accounts receivable functions and operations, the ability to manage and prioritize a large workload, ensure you meet all deadlines, and communicate with customers and clients in a clear and easy-to-understand manner. Communication and interpersonal skills are vital working in accounts receivable.

You need good working knowledge of accounting principles, be aware of the organizations accounting policies and procedures, and possess excellent mathematical and numeracy skills.

Attention to detail skills are also at the top of the list in terms of skills and qualities needed, and you must have good working knowledge of a variety of software packages, apps, and accounting tools to fulfil your duties competently.

Finally, you must possess critical thinking skills, be able to work alone as well as part of a team and be detail-orientated.

THE DAY-TO-DAY DUTIES AND JOB DESCRIPTION OF AN ACCOUNTS RECEIVABLE CLERK OR SPECIALIST

As an accounts receivable specialist, you would have many and varied duties and responsibilities, including:

Describe Your Experience In Complying With Financial Laws And Regulations How Do You Prepare For A Potential Audit

Accounts receivable specialists must have a basic understanding of financial rules and regulations, including compliance with records and file management. Evaluate your candidates experience in this area by listening to how theyve ensured compliance with accounts receivable document aging. This may be a manual system or an electronic one. You will want to understand whether your candidate has experience in managing information so it can be audited easily as well. What to look for in an answer:

- Knowledge of financial rules and regulations

- Understanding of audit requirements

- Experience with accounting records retention

Example:

Although accounting software has automated some of the regulation checks and balances, I have worked with an organization through an audit in the past.

You May Like: Where Can I Watch The Meghan Markle Interview With Oprah

What Are The Most Important Goals For The Accounts Receivable Team

This question allows the candidate to exhibit their knowledge of the job and its role within the greater organization. What to look for in an answer:

- Understanding of the impact on the company profits

- Confidence in explaining the department’s mission

- Experience working on an accounts receivable team

Example:

“I love working in the accounts receivable department because we play such an important role in helping company executives. We contribute to forecasting profitability and provide insight on where the organization should focus their efforts to help to improve cash flow.”

What Steps Do You Take In Resolving An Accounting Discrepancy

Even the most cautious accounts receivable specialist will make or discover an error from time to time. Youll want to understand how your candidate researches and resolves accounting discrepancies. Look for an emphasis on documenting findings and comprehensive descriptions of why the discrepancy occurred. Financial information can be sensitive, and theres the risk of mismanagement of funds. Youll want to understand how your candidates handle those situations. What to look for in an answer:

- Ability to provide extensive explanations

- Experience with finding and resolving discrepancies

- Willingness to work within your operating procedures

Example:

Its important to resolve accounting discrepancies completely and honestly. I always try to detail why the discrepancy occurred and assure a great deal of transparency.

Read Also: How To Clear Coding Interview

How Do You Manage Your Time In Accounts Receivable

How to Answer

With this behavioral based interview question, the hiring authority wants to hear that you are working wisely and not wasting much time during the day. Think about the ways that you control your time during the day. Perhaps you have a to-do list or plan your day using a particular app or software program. Whatever your method, ensure the interviewer that you are mindful of your time. Show that you deliver quickly on your work while maintaining exceptional quality and accuracy.

Written by Rachelle Enns on January 7th, 2019

Answer Examples Have Been Hidden

Please upgrade to view

How Do You Minimize Errors In Your Day

Being relatively error free in an accounting environment is immensely important to the employer. Employers may want to know how you will aspire to work as error free as possible. While perfection is a high aspiration, explaining your methods in perfectionism may leave a good impression on the interviewer if done so honestly.

Example:”I’m not perfect, but I try to prioritize correctness over work-speed. The method I use that’s worked so far is to triple-check and compare once before it leaves my work-station. The most challenging part of this is that in my previous workplace, work-speed was important. Often I was pushed to question if I really needed the extra care when work was becoming backed-up throughout the day. In the end, I tried very hard to prioritize doing quality work over quantity.”

Don’t Miss: One-way Video Interview Discrimination

This Job Is Quite Repetitive How Do You Plan To Motivate Yourself In Work

First and foremost, try to speak with enthusiasm in your voice . They shouldnt get the impression that you apply with them just because you need money, and that you see nothing good about the job.

You can say that you are a team player, and look forward to meet new people in work. You do not want to let them down, and so you always try your best in work, so the entire team can excel.

Alternatively you can refer to your goals , and say that you understand the importance this job plays in your professional career . Keeping bigger picture always on your mind helps you to see meaning in seemingly meaningless and repetitive duties

Special Tip: Feeling anxious before the start of your interview? Have a look at our Interview Success Package, learn how to answer every difficult behavioral question they may throw at you , get rid of your interview stress for good, and get a job of an account receivable clerk.

What Are Your Strengths

While this question is an invitation to do some chest pounding, remember to illustrate strengths that will benefit the employer and arerelative to the position. For example:

- being a problem solver

- the ability to perform under pressure

- a positive attitude

Are typically all solid strengths, but again, consider the position. For example, mentioning you are an excellent team player in a job where you largely work alone suddenly becomes irrelevant to the employer and demonstrates a genuine lack of self awareness.

Beyond this, present your strengths with confidence this is not the time to be modest.

Recommended Reading: Where Can I Watch Interview With A Vampire

What Accounting Software Are You Comfortable Using

This question provides insight into the type of technology the candidate is comfortable using and has experience with. What to look for in an answer:

- Experience with relevant accounting technology

- Specific software programs the candidate has used

- Ability to learn new software programs

Example:

“The software program I’m most familiar with is Sage Intact. I’ve been using it for five years at my current job. However, I’m a quick learner and can learn any software program your company uses. I usually take a day or two to familiarize myself with the program, and can learn as I go.”

What Are Your Weaknesses

Another tricky one. The purpose of this question is to see how you view and evaluate yourself.

One the one hand, if you suggest you dont have any weaknesses, your interviewer will almost certainly see you as a lair, egotistical, or both.

Dont fall into the trap of trying to present a positive skill in disguise as a weakness, like I work too hard or I am a perfectionist. Any experienced interviewer will see through this in a heartbeat.

Additionally, revealing that Im not really a morning person and have been known to come in late raises immediate and obvious red flags.

The trick here is to respond realistically by mentioning a small, work related weakness and what you are doing or have done to overcome it.

Don’t Miss: Where Can I Watch Prince Harry Interview

What Are Your Salary Expectations

Many consider this question to be a loaded gun dangerous in the hands of the inexperienced. Often times, an interviewee will start talking salary before theyve had an opportunity to illustrate their skill set and value making any sort of leverage valueless. Here, knowledge is power, as salary often comes down to negotiation. Do some research into your industry to establish base rates of pay based on seniority and demand but keep in mind your employer is hiring you for what they believe you are worth, and how much benefit they feel you will provide.

One relatively safe approach is simply asking the interviewer about the salary range. If you wish to avoid the question entirely, respond by saying that money isnt a key factor and your primary goal is to advance in your career.

Why Did You Leave Your Last Position

This is a question often asked by employers so that they can get to know the history regarding the applicant in a condensed, efficient way. Employers want to ensure that the last position an applicant held was left on good terms, and what their most recent work experience contained. Consider including details that would display good elements of your previous position, what you enjoyed about the work there and what skills and experiences you’ve had that would relate to the position you’re applying for.

Example:”Working at my previous position was a significant experience for many reasons. It presented new challenges and gave me the opportunity to garner experience in the accounting field. I definitely learned how to work in a fast-paced environment I was one of the few staff that the company had as a startup, so work never quite slowed down. I left on great terms, mostly because I wanted to seek new challenges and experiences in the accounting field.”

Recommended Reading: How To Create A Presentation For An Interview

What Steps Do You Take To Prepare For An Audit

This question assesses whether the potential candidate has experience being audited and what steps they take to ensure compliance. What to look for in an answer:

- Confidence in their understanding of auditing requirements

- Organizational skills

- Knowledge of Canadian financial regulations

Example:

“My current company has an internal auditing process that takes place every year. I hand over all our financial statements for the year prior. For this reason, it’s incredibly important that I stay very organized at all times. I have a meticulous filing process to ensure I can find all financial documents quickly when needed. I also think it’s important to stay up to date with regulatory changes, so I’m a member of the provincial association.”