Let Your Experience Speak For Itself

Although it is an interview, the case interview is not intended to be a time to discuss your resume. Regardless of your prior experience with the subject of your case, focus on using the unique insights you have and applying them to the problem, rather than discussing your work experience at length.

Nina summarized the difference by saying, Dont use the case to highlight your resume, but do draw in your experience as a human. You will have an opportunity to discuss previous work experience in other types of interviewslike our Behavioral or Job Fit interviews. You can still demonstrate skills from your previous experience through your practical work on the case. General life experience and common sense can be immensely helpful in case interviews as well.

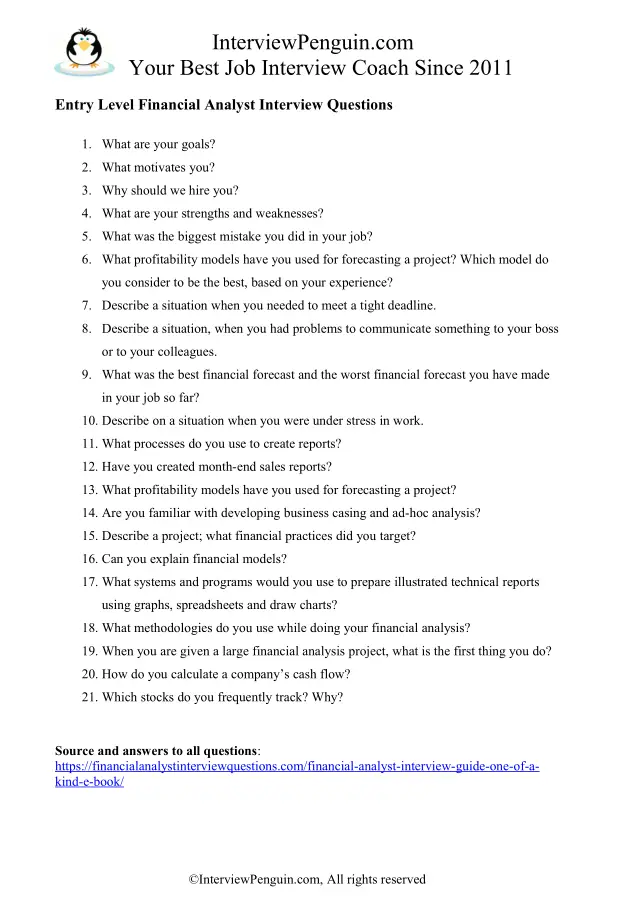

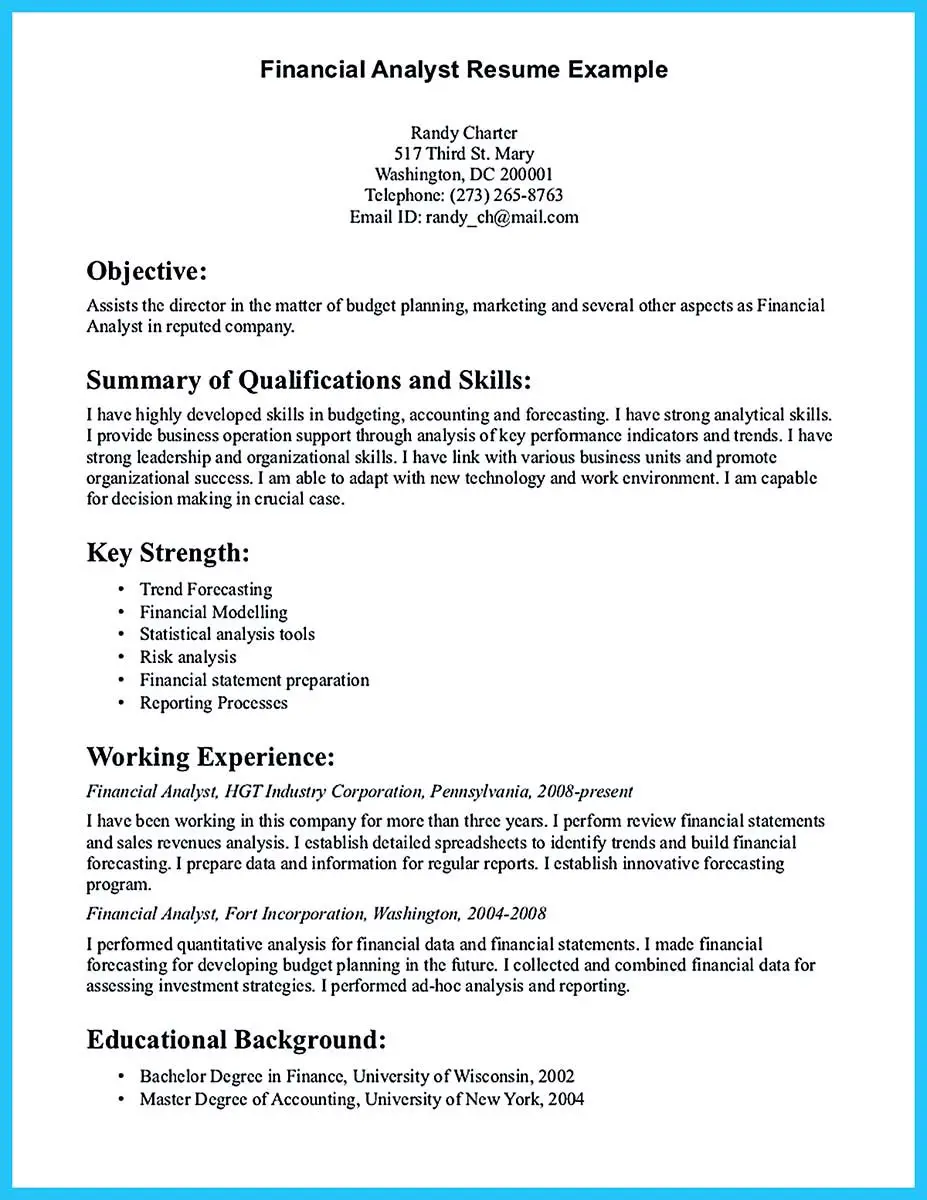

What Would You Say Is Your Greatest Strength That Could Benefit Your Career As A Financial Analyst

Example:”I believe that discipline is my greatest strength that I could apply to a financial analyst position. For example, when I am reviewing company financial records and documentation, I focus on that task alone until I complete it. I am able to avoid procrastination and other time-wasting activities because I am geared toward accomplishing the end goal.”

Related: 39 Strengths and Weaknesses To Discuss in a Job Interview

What Processes Do You Use To Create Financial Analysis Reports

Reporting is generally a big part of a financial analysts job, and the reporting required will depend on the role. If youre interviewing for a sales organization, for instance, you might be creating monthly, quarterly, or annual sales reports. In your answer, theyll be looking for technical skills as well as collaboration skills, communication, organization, follow-through, and time management.

Don’t Miss: Good Interview Questions To Ask Production Workers

What Do You Think Is The Best Metric For Analyzing A Company’s Stock

This question tests a candidate’s risk assessment knowledge. An excellent candidate would explain their strategy for measuring a stock’s performance. What to look for in an answer:

- Knowledge of the best metrics for analyzing stock

- Understanding of risk assessment strategies

- Critical-thinking skills

Example:

“The price-earnings to growth ratio is a good metric for analyzing a company’s stock performance. If the value is greater than one, the stock is overvalued. Otherwise, it’s undervalued or fairly priced. In my experience, the PEG metric gives more insight into a company’s financial health. It considers the projected earnings growth.”

The Amazon Fldp Interview

This interview consists of four face-to-face interviews, each is 45 minutes, and usually, there are no breaks in between . The interview questions are primarily behavioral and focus on .

Since these are Amazon’s core principles and you’ve applied for a leadership development program, they will expect you to base your answers on them.

Additionally, the interviewers will dive deep into your answers and analyze every detail you provide. Therefore, try to stay very consistent with your answers.

Many candidates mention that one particular interviewer was different from the others. This interviewer is there for a reason, and they are called Amazon Bar Raisers.

The Amazon Bar Raisers are skilled evaluators that are not part of the hiring department. Their central role is to provide authentic and reliable opinions on whether you should get hired or not. For that, they use several tactics designed to throw you off and test your leadership skills and resilience.

The best way to handle them is by maintaining your composure, keeping your answers and explanations tight, and sticking to Amazon’s leadership principles.

Also Check: What Is An Exit Interview For A Job

Imagine You Found Inconsistencies In A Company’s Financial Reports How Would You Handle The Situation

This question helps you understand how a financial analyst would respond to an ethical dilemma or potential issue. What to look for in an answer:

- Desire to follow and enforce ethical business practises

- Honesty and moral values

Example:

“At my last job, I was analyzing a startup’s financial records. I found that the cash inflow didn’t quite add up to the company’s cash outflow. There was no explanation for the imbalance from the records I had. I first double-checked before notifying my finance manager of the situation. She later contacted the business owner. I pay keen attention to details and always act ethically when dealing with customers, employers, or my colleagues.”

Technical Questions For Pe

The topics here are similar to the ones in IB interviews: Accounting, equity value and enterprise value, valuation/DCF, merger models, and LBO models.

If youre in banking, you should know these topics like the back of your hand.

And if youre not in banking, you need to learn these topics ASAP because firms will not be forgiving.

There are a few differences compared with banking interviews:

- Technical questions tend to be framed in the context of your deal experience instead of asking generic questions about WACC, they might ask how you calculated it in one specific deal.

- More critical thinking is required. Instead of asking you to walk through the financial statements when Depreciation changes, they might describe companies with different business models and ask how the financial statements and valuation would differ.

- They focus more on LBO models, quick IRR math, and your ability to judge deals quickly.

Most interviewers use technical questions to weed out candidates, so poor technical knowledge will hurt your chances, but exceptional knowledge wont necessarily get you an offer.

Recommended Reading: How To Sight An Interview

How Would The Income Statement Change If A Company’s Debts Increased

An interviewer asks this question to assess how prepared you are for a financial analyst position and whether you have the correct expertise to perform well. Your answer should directly address how company debt affects an income statement.

Example:”If a company’s debts increased, this would decrease the net income listed in a company’s income statement.”

Related: Math Interview Questions

If You Could Only Choose One Profitability Model To Forecast Your Projects Which Would It Be And Why

This is another question that interviewers use to gauge your knowledge of industry terminology. When you give your answer, specify a model and explain your reasoning for choosing it.

Example:”I would usually choosea profitability model that reflected the type of business I was forecasting, but if I had to choose one for all of my projects, I would use the financial model because a company’s finances are constantly fluctuating.”

Related: What Is the Difference Between Profitability and Profit?

Recommended Reading: What Questions To Ask A Ux Designer In An Interview

Private Equity Interviews : How To Win Offers

If you’re new here, please click here to get my FREE 57-page investment banking recruiting guide – plus, get weekly updates so that you can break into investment banking. Thanks for visiting!

Private equity interviews can be challenging, but for most candidates, winning interviews is much tougher than succeeding in those interviews.

You do not need to be a math genius or a gifted speaker you just need to understand the recruiting process and basic arithmetic.

Still, there is more to PE interviews than 2 + 2 = 4, so lets take a detailed look at the process:

How Many Food Stores Do You Think There Are In Singapore

This is another guess or market-sizing question. Answering this question may necessitate you answering questions to get statistical information, which you can then use to estimate a number that most answers the question. To answer this type of question, you can ask clarifying queries, create a structured process for deriving the answer, estimate with round numbers and ground your estimations with existing facts.

Recommended Reading: How To Succeed In An Interview

What Are The Most Common Financial Modeling Interview Questions

In this Financial Modeling Interview guide, weve compiled a list of the most common and frequently asked financial modeling interview questions. This guide is perfect for anyone interviewing for a financial analyst job or any other role requiring knowledge in the field as it helps you prepare for the most critical questions relating to financial modeling concepts and application.

Alongside with this comprehensive guide to financial modeling interview questions , you may also be interested in exploring The Analyst Trifecta CFIs guide on how to be a great financial analyst.

Fp& a Interview Questions With Answers:

Walk me through the three financial statements.

The balance sheet shows a companys assets, liabilities, and shareholders equity, and is a snapshot in time. The income statement outlines the companys revenues and expenses over a period of time . The cash flow statement shows the cash flows from operating, investing, and financing activities over a period of time. The three financial statements all fit together to show a picture of the companys financial health.

How does an inventory write-down affect the three statements?

This can be one of the more challenging FP& A interview questions. Here is the answer: On the balance sheet, the asset account of inventory is reduced by the amount of the write-down, and so is shareholders equity. The income statement is hit with an expense in either COGS or a separate line item for the amount of the write-down, reducing net income. On the cash flow statement, the write-down is added back to Cash from Operations, as its a non-cash expense, but must not be double-counted in the changes of non-cash working capital.

How do you record PP& E and why is this important?

There are essentially four areas to consider when accounting for PP& E on the balance sheet: initial purchase, depreciation, additions , and dispositions. In addition to these four, you may also have to consider revaluation. For many businesses, PP& E is the main capital asset that generates revenue, profitability, and cash flow.

What does it take to be a great FP& A analyst?

Don’t Miss: What Questions To Expect In An Exit Interview

Validate Corporate Structure And Business Model

Always remember to validate the corporate structure and business model of the financial institution in your financial services case interview. You dont want to end up confusing a commercial bank with an investment bank!

As a candidate, youre not expected to know everything. Therefore, ask as many questions as possible to understand what youre really dealing with. For instance, you could say, Hey, Im not familiar with the corporate structure and the business model of a pension fund, could you please explain that to me so I can start to understand the drivers of value for the business a bit better.

What Employers Are Looking For

Microsoft Excel is a comprehensive tool that allows businesses to record, track, and analyze data essential for measuring company performance, maximizing return on investment, and defining goals when used to its fullest potential. A new employee who can comfortably navigate Excel is prepared to immediately contribute by producing meaningful, data-driven spreadsheets, reports, and graphs to best serve company needs.

Assessing a job candidates Microsoft Excel proficiency is an important step in making the right hire. The Beginners Microsoft Excel skills test is helpful in learning if a job candidate understands how to manipulate the many functions, tools, and formulas of Excel to present extensive information, identify key trends, or calculate financial and numerical data.

Microsoft Excel assessment test helps predict a job candidates ability to:

- Enter sales figures and properly apply formulas to generate sales totals by date, representative, product or region.

- Conditionally format cells with the goal of highlighting specific dates, values, or ranges.

- Create bar graphs and pie charts from large datasets to illustrate critical company data, performance metrics, and outlook.

Recommended Reading: How To Reject Applicant After Interview

Complexity Levels Of Excel Employment Assessment Tests

Microsoft Excel harbor very basic calculations to very advanced data processing and analysis that requires in-depth knowledge of every tools of Excel. Depending on the position candidate is applying for you are likely to face a pre-employment Excel test with varying level of difficulty. Microsoft Excel Employment Assessment tests can be categorized into at least three levels of difficulty:

How Would You Describe Your Ability To Work With Others

Financial analysts often need to work with portfolio managers, financial managers, and accountants. This question evaluates whether a candidate is a team player. Their answer would give you insights into which team or groups to place a financial analyst. What to look for in an answer:

- Teamwork and collabouration skills

- Strong interpersonal and communication skills

- Motivated to reach a shared goal for clients and your organisation

Example:

“I work well with other finance and accounting professionals to reach a shared goal. In my last job, my manager grouped me with two senior and four junior financial analysts. Our goal was to analyse investment opportunities for a top bank in Ontario. Working with experienced professionals helped develop my analytical skills. I also improved my leadership skills by working with junior financial analysts.”

You May Like: What Questions To Ask In An Executive Assistant Interview

Putting It All Together

Ultimately, learning that you get to come in for a financial analyst interview is always exciting. While youre probably going to be at least a teeny bit nervous, that doesnt mean you cant shine.

Just use the tips above and spend time reviewing the financial analyst interview questions. That way, you can create engaging, thorough, and relevant answers that will help you stand out in the eyes of the hiring manager. After all, you are an exceptional candidate. Now, all you have to do is show it.

And as always, good luck!

Ideas On Incentives For Agents

- Financial

- Provide commission to agents of 0.15% on each insurance/loan product.

You could classify high performers as agents with transaction volume and transaction value in the top 10%. Agents potential information can also be collected to have a more nuanced segmentation for tracking and governance purposes.

Don’t Miss: How To Prepare For Analyst Interview

Tips For Performing Well At Investment Banking Case Studies

While working on the Investment Banking Case Studies

- Make a concrete decision and base your recommendations on logical reasons.

- Use a structured approach to tackle the problem.

- Focus on the most important issues prevalent in the case.

- Understand the case and questions carefully before interpreting and think twice before finalizing the problems decision.

- Do not panic if the solution to the case is not obvious.

- For modeling case studies, format the excel and PowerPoint professionally.

- Prepare the type of questions you may be asked during your presentation.

- Assess all the relevant factors and possible problems, but keep in mind your resources.

- The solutions you provide should be realistic and be aware of the implications of the organizations under study.

- Have strong logical reasons behind every statement you make and cater to the cases critical issues at the beginning.

- Having specific knowledge regarding the industry under study is unnecessary, but it would be an added advantage.

- When preparing, focus on reading deal news and practice as many scenarios as possible.

While presenting your Investment Banking Case study

While Answering the Questions

What Qualities Do Capital One Case Interviews Assess

Capital One case interviews assess four main qualities:

Logical, structured thinking: Capital One looks for candidates that are organized and methodical problem solvers.

- Can you structure complex problems in a clear, simple way?

- Can you use logic and reason to make appropriate conclusions?

Quantitative skills: Capital One looks for candidates that have strong analytical skills to solve complex business problems and make important business decisions

- Can you read and interpret data well?

- Can you perform math computations smoothly and accurately?

- Can you conduct the right analyses to draw the right conclusions?

Communication skills: Capital One looks for candidates that can communicate in a clear, concise, and persuasive way.

- Can you communicate in a clear and concise way?

- Are you articulate and persuasive in what you are saying?

Business judgment: Capital One looks for candidates with strong business instincts that help them make the right decisions and develop the right recommendations.

- Do you have a basic understanding of fundamental business concepts?

- Do your conclusions and recommendations make sense from a business perspective?

Read Also: How To Prepare For A Phone Job Interview

How To Answer Financial Analyst Interview Questions

Alright, before we talk about the interview questions and examples, lets take a step back. Knowing how to answer is at least as important as seeing samples, if not more so. By having a winning strategy by your side, you can handle the unexpected, and that can make a world of difference.

So, what do you need to do?

Well, step one in a winning strategy is always the same its research. Usually, hiring managers have a perfect candidate in mind before they meet a single applicant. If you can figure out who that person is and what they bring to the table, you can showcase the skills and traits you have that align with it.

Certain skills and traits are going to be givens. You need to have an analytical mindset, math skills, and an understanding of micro and macroeconomics, for example. However, that isnt going to be all the hiring manager is looking for. If you want to get the full picture, you need to do some digging.

Start by reviewing the financial analyst job description. There, youll find a list of all of the must-have skills, traits, and other credentials. If a capability is listed there, theres a good chance youll face financial analyst interview questions about it.

But you also want to go further. If you take a trip to the company website, you can find its mission and values statements. Those provide you with a ton of insights about the organizations goals, priorities, and even its culture.