Show That You’re Interested

At the beginning of your interview, you can start by showing how interested you’re to start working in your position as an investment banker. You can also briefly discuss what you know about investment banking and how it’s applicable to your future responsibilities in the position. Showcase your work ethic and readiness in facing challenges you may encounter during your time in the company.

Why Is It Better For Companies To Issue Debt Rather Than Equity

This is another technical question that interviewers may ask to know if you possess in-depth knowledge and skills to accomplish financial tasks. Practise answering so that you can remember all the details.

Example:’From my knowledge, there are a few reasons a company would rather issue debt than equity. First, issuing debt is more risk-free and uses up much less capital compared to issuing equity. Second, when the business has taxable income, tax shields are available. Third, issuing debt is better for companies with consistent cash flows that can make interest payments. Fourth, higher financial leverage helps maximise the profits from invested capital. Fifth, when issuing debt can produce a lower weighted cost of capital in comparison to issuing equity.’

How Many Gas Stations Are There In The United States

Answer:With a question like this, the interviewer is looking at your thought process, not that you can figure out how many gas stations are in the U.S.

The easiest way to go about answering a question like this is to start small and work your way to the bigger question.Think about your town. Say your town has 30,000 people, and you have 5 gas stations serving that area.The United States has approximately 300 million people, so that means there are 10,000 “towns” in the United States, and 50,000 gas stations. You then want to make adjustments. For example, assume that a quarter of the population lives in larger cities where there is only 1 gas station per 30,000 people.So you have 7,500 towns with 5 gas stations and 2,500 “towns” with only 1.

Do a little mental math and you get the number of 40,000 gas stations in the U.S.

Also Check: What To Say In A Interview Follow Up Email

And Not Just For Why Investment Banking

You need to use this answer for more than just the Why investment banking? questions: you have to use it in your story and also when youre networking, because anyone you contact will ask why youre interested.

Especially if youre coming from a non-finance background, figuring out your reason why is critical because most peoples rationale consists of I want to make more money!

Why Should We Hire You

Be ready for this one. Be confident but not cocky. Highlight that you are the right candidate because you can hit the ground running and are flexible enough to move with the changing environment. The core competencies essential to an investment banking career are: problem solving ability, professional attitude with willingness to adapt and remain flexible, leadership and communication abilities, resourcefulness and the drive to succeed.

Also Check: What To Do In An Exit Interview

What Are The Main Components Of Wacc And How Do You Calculate It

Weighted average cost of capital is a formula used to determine the return on investment in a company, and it is comprised of the sum of a companys proportional debt and equity multiplied by the cost of debt and cost of equity, respectively.

WACC = + )

- Equity is the market value of the companys outstanding shares, so E/V is the percentage of the companys value that is equity.

- Debt is the market value of the companys debt, so D/V is the percentage of the companys value that is debt.

- Value is the value of the companys capital, or E+D.

- Re is the cost of equity

- Rd is the cost of debt

- Tax is the corporate tax rate.

Exposure To High Profile Transactions

When something is finally disclosed, it usually appears on the front page of the business section because the majority of what bankers work on is top secret until it is made public. This expresses a pretty compelling reason to enter the industry and is likely to stroke the interviewers ego if you say something to this effect.

Recommended Reading: How To Ask About Remote Work In An Interview

Q How Would You Calculate Beta For A Company

Calculating raw betas from historical returns and even projected betas is an imprecise measurement of future beta because of estimation errors . As a result, it is recommended that we use an industry beta. Of course, since the betas of comparable companies are distorted because of different rates of leverage, we should unlever the betas of these comparable companies as such:

- Unlevered = /

Then, once an average unlevered beta is calculated, relever this beta at the target companys capital structure:

- Levered = x

Explain Minority Interest In Laymans Terms

According to the reported questions weve analyzed, this question is only asked in Morgan Stanley interviews. So, if youre only interviewing with other firms, then you should prioritize the other questions in this list before preparing for this one.

In simple terms, minority interest is a person or company that owns less than half of a company.

If youd like to learn more about minority interest in-depth, you can check out this guide from Investopedia. Here are a few highlights:

- Minority interest is also sometimes called NCI because they typically dont get to make decisions on behalf of the company.

- There are two sub-types of minority interest:

- Active minority interest: owns 21-49% of the company and has some influence on decision making.

- Passive minority interest: owns 20% or less of the company and has little-to-no influence on decision making

- Minority interest is recorded on the balance sheet of the majority owner as a liability.

Read Also: How To Give A Great Interview

Basic Questions To Ask The Interviewer

- How long have you been with the bank and how has your experience been?

- What do you like/dislike most about working with this bank?

- How do you compare working here with other banks at which you have worked?

- What kind of responsibility does the typical Analyst/Associate receive?

- What differentiates a good Analyst from a great Analyst?

- Whatâs your favorite deal that youâve worked on at the bank?

- Can you tell me about your Associate training program?

- How do Analysts/Associates get staffed at your bank?

- On what types of deals are you currently working?

- How is the deal flow at the bank? In your group?

Focus On How Can You Do To Benefit Company

You must demonstrate to the interviewer that you want to advance both your professional and personal goals while working with their company. Making money for the company is one of an investment bankers main responsibilities, so its critical to show them how you can do this for them. Its a good idea to give specific examples of how youve successfully closed deals or made sales in the past.

Emphasize how you can help the organization make money. It is advisable to hold back on discussing your personal financial goals. The interviewer might only be interested in the fact that you care more about the company than you do about personal gain.

Also Check: What Are Some Interview Questions For Nurses

How Are The Three Main Financial Statements Connected

Sample Answer:Net income flows from Income Statement into the Cash Flow Statement as Cash Flow from Operations. Net income less dividends are added to retained earnings from the prior period’s Balance Sheet to come up with retained earnings as on the date of the current period’s BS. The opening cash balance on the CFS is from the prior period’s Balance Sheet while the closing cash balance on the CFS is the balance on the current period’s Balance Sheet.”

The following chart gives you a more comprehensive overview of how the 3 financial statements are connected to help visualize and present better for your interview:

Q: Where Do You See Yourself Professionally In Five Years

Five years is a long way down the road, but I know that finance will always have a grip on me. I could see myself in investment banking for the long-term, but that would have to depend on my performance and my family situation. I would definitely like to stay in financial services, using the skills Iâve learned and continuing to build solid and meaningful professional relationships.

NOTE: You want to demonstrate that you are committed to investment banking, but you donât want to be disingenuous by stating that banking is the only job youâll ever want to do. If youâre interviewing for an analyst role, you donât need to demonstrate that you are committed to investment banking long-term bankers are in a two-year program, and then theyâre out. Be sure, however, to mention that you are very excited about becoming an analyst and that you want to learn as much as possible, get as much transaction experience as possible, etc.

On the other hand, if youâre interviewing for an associate position out of MBA school, you will need to demonstrate commitment to investment banking.

You May Like: Interview Questions For Director Level Positions

What Are Some Of The Key Differences Between Bonds And Loans To Determine Which One Is Better For A Company What Are Examples Of When You Would Choose Each

Investment bankers often work with many types of loans and bonds, making important decisions about buying and selling them. Interviewers may ask this question to explore your analytical process for utilizing loans and bonds.

Example: “Loans have higher priority than bonds in the event of bankruptcy, but there may be situations when loans tie up capital that a business could otherwise reinvest in the company. Determining which is better for a company depends on the maturity date of the loan versus bond. For example, if you expect a sudden influx of cash from one of your business lines, you may want to use debt to pay off the loan and gain access to these funds.”

Q: What Motivates You

What drives me the most is competition. I always want to be the best in everything I do, whether it is academics, sports, or even poker. Another example is golf: my Managing Director took me to the golf course for the first time this summer, and since then Iâve bought my own Callaway clubs and have gone to the driving range every other day during school. Once I decide I want something, it becomes all I think about and strive for. Iâm an all-or-nothing kind of guy.

Don’t Miss: How To Send A Thank You After An Interview

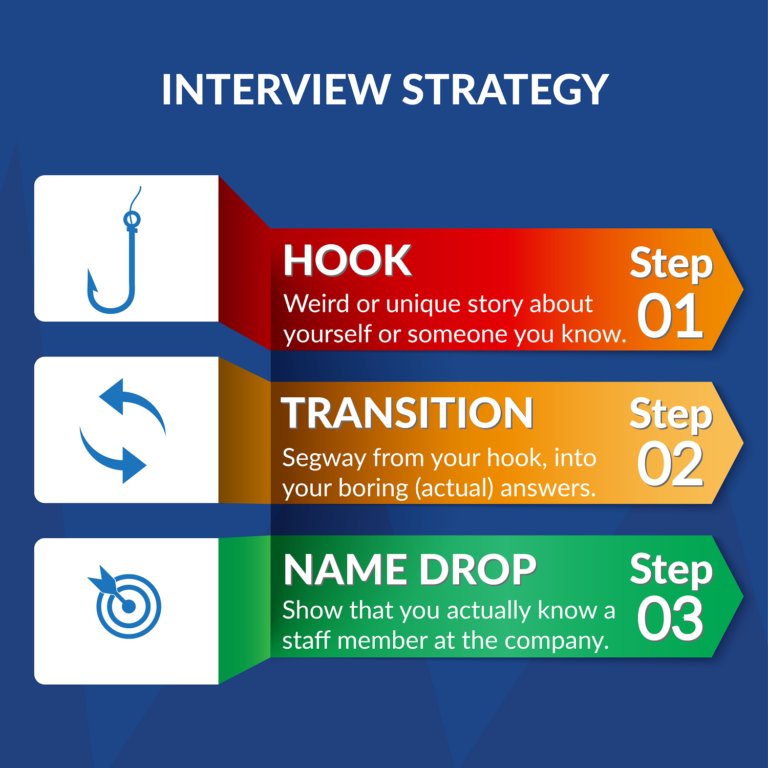

For Graduates And Career Switchers

Step 1: Start with a key messageas mentioned above

I really want to work in Investment Banking.

Step 2: Continue with your background

Prior to MBA, I worked in a healthcare company. I used to think that I would pursue healthcare and medical until one day, another bigger firm stepped in to acquire my company. Ive changed my mind since then.

My boss pulled me into the deals so that I could provide numbers and comprehensive and granular analysis for the M& A team, which got me interested in finance in the first place. I thought about switching to finance, that explained why I decided to do an MBA program.

Step 3, 4: What do you do to meet requirements for a finance/investment banking role and conclusion

Though starting with a non-finance major, MBA program provided me with business and finance knowledge, valuations and financial modelling.

I see myself in the next 5-10 years that I want to advise healthcare and medical firms, since combining my healthcare background and banking experience makes a great match.

Common Answers For Why Investment Banking

-

Learning experience

-

Intimate exposure to Excel, PowerPoint

-

Deal making involves coordinating different stakeholders

-

Learn about how transactions come together

-

Work with the largest companies in the world

-

Help give strategic advice to companies when they need it most

-

Learn how to dynamically work with different teams

-

Learn about client servicing

-

Want to work with smart and motivated people

There are likely many more, but this probably covers 90%+ of what most people will say. I would recommend picking from this time-tested list and no one will dock points from you for being relatively ordinary.

Where you can shine and be more creative is with how you connect these points to individual events in your life.

Its a bad answer if you say that you just want to learn a lot. But if you say that you got to shadow someone at a hedge fund last year and your favorite aspect was the ability to interact with many different businesses, then youll have a much better answer.

Don’t Miss: Online Interview Invitation Email Sample

Typical Questions About Your Interests And Achievements

- What do you do in your free time?

- What is your greatest achievement?

- Who has influenced you?

- What kind of person are you?

Investment banking careers arenât only glitz and glamour and fat pay cheques. A lot of hard graft and long hours are involved. And this working culture doesnât kick in when you make it to executive level it begins in your internship.

This could be why banks ask questions such as those above to find out if youâll be a cultural fit. To prove that you will be, choose examples and facts that connect to the requirements of the position to which you have applied.

If asked, âWhat kind of person are you?â, for instance, explaining that youâre motivated and tenacious, which is evidenced by your 50-mile run for WaterAid, would probably go down a storm. Banks look for those qualities and support many charities.

How Do Investment Bankers Value An Organisation

The interviewer may ask this to determine if you understand valuation techniques. You can demonstrate your ability to assist other companies with making financial projections. By researching and rehearsing answers to technical questions, you can reply in a precise and efficient manner during your interview.

Example:’The two methods you can value a company are intrinsic valuation, or discounted cash flow, and relative valuations, or multiples. The discounted cash flow valuation helps to determine if a firm receives expected returns from investments, resulting in a consistent valuation. Multiples are subjective, and they can result in a variety of valuation computations. The pace at which a firm grows is still taken into account when calculating its value.’

Recommended Reading: How To Make An Interview Video

What Are The Main Factors That Cause A Need For Mergers And Acquisitions

The major factors that lead to a merger and acquisition include:

- Improving financial health and overall metrics

- Eliminating competition from the market

- Gaining more power over pricing by buying out a distributor or supplier

- Diversifying or specializing expanding the companys product or finding ways to make it more niche for a specific market

- Expansion of technological abilities, or absorbing new technologies from acquired companies

What Is 17 Squared What’s 18×22

Answer:Don’t worry they want to know how you will handle this question, and it is not difficult if you think about it correctly.

Think 17 x 17 is just 17 x 10 plus 17 x 7. You know 17 x 10 is 170. Now 17 x 7 is 10 x 7 and 7 x 7. This gives you 170 + 70 + 49, or 289. Whatever you do, don’t panic!

Now see if you can do 18 x 22: 18 x 20 + 18 x 2. Easy, 360 + 36 = 396.

As far as brainteasers go, this is a rather common one. You will do better if you have practiced these types of questions.

Recommended Reading: How To Crack Scrum Master Interview

What Skills Have You Learned From Previous Roles That You Think Transfer To An Investment Banking Position

Professionals in investment banking have a strong background in finance, accounting or mathematics. Review your resume to find out which skills from these roles can amplify your performance in an investment banking role.

Example:”Since I have an accounting background, I believe my ability to understand complex calculations gives me the confidence to offer financial advice to clients. During my previous accounting internship, I assisted the controller with proofreading balance sheets, invoices and financial reports to ensure their accuracy. I ended up correcting two mistakes that allowed the management team to present these reports to external stakeholders on time. I think this experience prepares me for working with clients in high-intensity situations.”

Q: Give An Example Of When You Failed Or Made A Mistake

During my last internship I had to help out another intern. I taught him some concepts incorrectly because I was rushed, and I made the incorrect assumption that he would figure it out. He didnât and that friend had to quit the internship program. We were very close, and it was devastating. I felt responsible. From that experience, I learned that I had to take being a leader much more seriously, and that my example was crucial for others to succeed. I also learned that I must show better attention to detail and not assume everything is running well without my input.

NOTE: Really think this one out and give a truthful answer. Again, this is another âweakness question.â Where possible, explain what youâve learned from it and how you can improve.

Don’t Miss: How To Ace A Nursing Interview

Describe Some Risks Youve Taken How Did You Make The Decisions

An investment bankers job often involves tough decisions, keeping in mind the political changes, various macroeconomic variables and the market trends. The ability to take risks is important. You need to demonstrate adequate analytical skills and how they were used in managing risk associated with a particular deal. You should highlight the logical assumptions and calculated guesses made by you while undertaking a risky project or decision. In an investment banking career, it is often more about being roughly right than precisely inaccurate.