Which Online Tools Cloud Software Or Other Accounting Specific Platforms Are You Familiar With

Youd be hard pressed to find an accounting firm these days where software isnt at the cornerstone of how they operate. If your experience lies in a single or outdated platform, be sure you are familiar with the current standards. Do some research and investigate new platforms or recent developments in the software field.

Answer Sample:

The bulk of my experience lies with the x platform, but Im fascinated with some of what the y system is capable of

Important Accounts Receivable Interview Questions

Detail your responsibilities in accounts receivable.

Discuss all your responsibilities. Focus on the skills and knowledge you used to perform these functions efficiently such as:

- maintaining a high level of accuracy

- good verbal and written communication skills

- strong organizational skills

- printing out relevant reports

What information is included in a bill for services?

List the information, make sure you cover everything and highlight your attention to detail. Include a sample of a bill for service that you created in your interview portfolio.

What was your average accounts receivable days outstanding?

If relevant, discuss any corrective action taken to reduce this figure.

What do you consider the most important goals of accounts receivable?

These goals will depend on the needs of the organization. Show how you are aware of organizational needs and then identify the appropriate goals to meet them.

Demonstrate a thorough understanding of what the goals express and how they support department and company objectives. Common aspects include:

- positively impacting on company cash cycle

- increasing cash flow

- reducing bad debt and write offs

What are your strengths as an accounts receivable professional?

Try to make your strengths relevant to the job requirements. This list of strengths is a useful resource for answering interview questions about your strengths.

Accounts Payable Clerk Interview Questions

The accounts payable clerk keeps track of a companys bills, ensures that charges are correct, and issues a payment before the due date. Successful candidates will be attentive, organized, and thorough. Avoid candidates who lack accounting or computer skills.

- Completely free trial, no card required.

- Reach over 250 million candidates.

Read Also: Work Life Balance Question Interview

Why Do You Want To Work In Accounts Payable At Our Company

Interviewers ask this question to determine whether you researched the company prior to your meeting. It’s beneficial to familiarize yourself with the company’s history, mission statement, and philosophy. The initiative shows that you have a genuine interest in working for that specific business. This question gives you the opportunity to detail how your accounts payable skills apply to the company and its goals.

Example:”I am eager to work with a company with whom I share values. This company’s dedication to diversity and long-standing record of success is inspiring. My professional experience in accounts payable matches the description, and I believe I can add significant value to the role. Because my values align with the business’ mission statement, I think my work approach and personality match the environment nicely.”

Read more:Interview Question: “Why Do You Want To Work Here?”

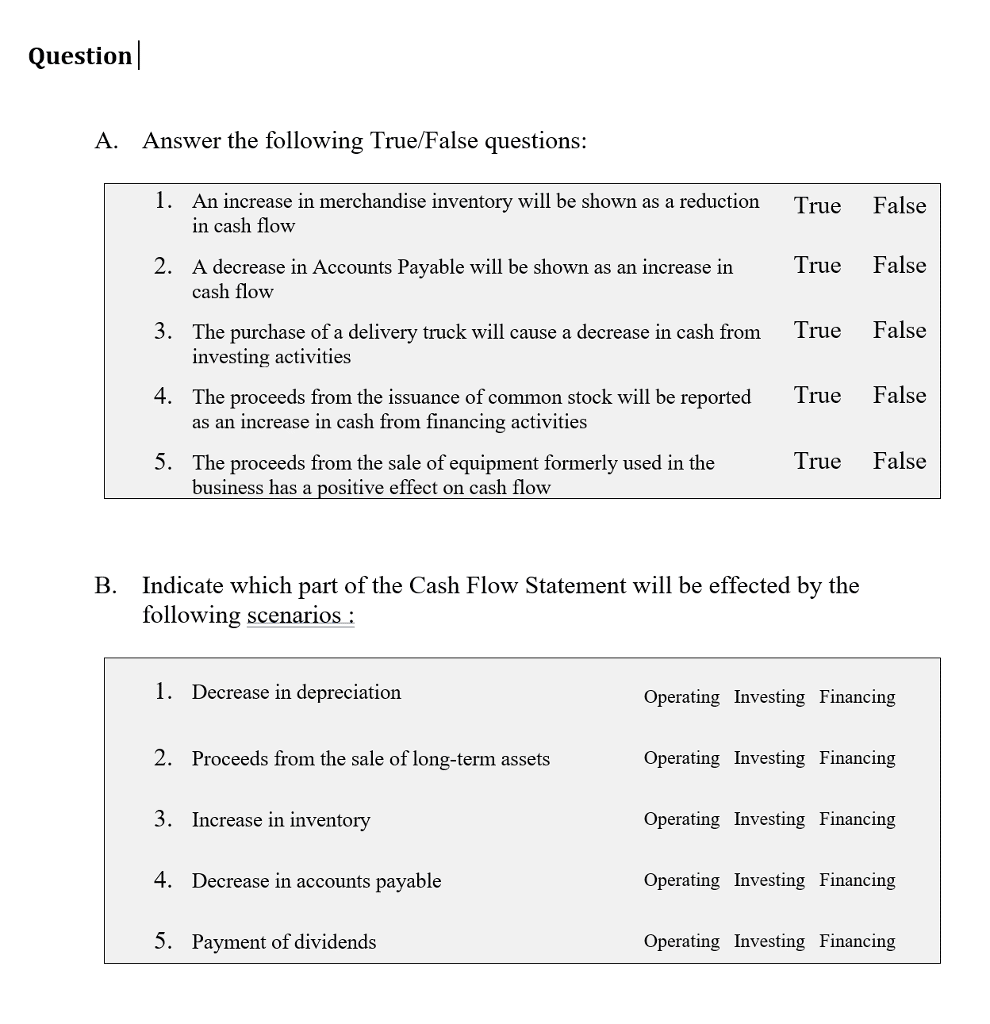

Finance Interview Questions :

Walk me through the three financial statements.

The balance sheet shows a companys assets, liabilities, and shareholders equity . The income statement outlines the companys revenues, expenses, and net income. The cash flow statement shows cash inflows and outflows from three areas: operating activities, investing activities, and financing activities.

If I could use only one statement to review the overall health of a company, which statement would I use, and why?

Cash is king. The statement of cash flows gives a true picture of how much cash the company is generating. Ironically, it often gets the least attention. You can probably pick a different answer for this question, but you need to provide a good justification .

If it were up to you, what would our companys budgeting process look like?

This is somewhat subjective. A good budget is one that has buy-in from all departments in the company, is realistic yet strives for achievement, has been risk-adjusted to allow for a margin of error, and is tied to the companys overall strategic plan. In order to achieve this, the budget needs to be an iterative process that includes all departments. It can be zero-based or building off the previous year, but it depends on what type of business youre running as to which approach is better. Its important to have a good budgeting/planning calendar that everyone can follow.

When should a company consider issuing debt instead of equity?

How do you calculate the WACC?

Answer:

Also Check: How To Get Prepared For An Interview

Top Accounts Payable Interview Questions

The Indeed Editorial Team comprises a diverse and talented team of writers, researchers and subject matter experts equipped with Indeed’s data and insights to deliver useful tips to help guide your career journey.

An interview for an accounts payable position tests your ability to perform key functions when working with employees in the accounting department. Understanding the different questions an employer can ask helps you prepare and answer them effectively. In this article, we will review accounts payable interview questions to gauge your experience as well as tips to help you succeed during this interview.

Related: Top 6 Common Interview Questions and Answers

Jenn, an Indeed Career Coach, breaks down the intentions behind employer’s questions and shares strategies for crafting strong responses.

Read more:

Please Describe A Time When You Couldnt Resolve A Discrepancy In An Account Or Ran Into A Technical Roadblock

No matter how much skill or practice applicants have, there will always be occasions when they have to learn something new. In addition to providing insight into their past accounting experience and technical abilities, this question reveals how they deal with challenges and frustration. An candidates answer here reveals how much they rely on others to come up with a solution.

What to look for in an answer:

- Level of technical proficiency

- Critical thinking and problem solving

- A routine that includes double checking

Example:

I had to format a report in a way our accounting software didnt allow. I exported it to another program and made changes there.

Read Also: How To Conduct A Group Interview

What Is Meant By Accounts Payable

Answer: For these accounts payable interview questions you could answer accounts payable means the amount that should be paid as a liability and that is paid to the vendors for goods and services that were purchased in the past on credit. Accounts payable will be entered in the balance sheet of the respective financial year that starts from 1st April this year to 31st March of next year.

Describe Your Ability To Work With Bookkeeping Software

The hiring manager is curious about your knowledge of bookkeeping software and your ability to learn it quickly. Highlight your experience level and where you need to expand your knowledge of this software.

Example:”I learned a lot about bookkeeping when I got my certification through the American Institute of Professional Bookkeepers. I used bookkeeping software in both of my previous accounting positions. I had a 64-week streak of making 100% on-time payments, leading to them hiring two more employees within the accounting department. I still view this as an area of improvement due to the daily changes within the accounting industry. I do believe that I can adapt to bookkeeping processes quickly to help out the organization.”

Also Check: How To Send A Thank You Email After An Interview

How Do You Minimize Errors In Your Day

Being relatively error free in an accounting environment is immensely important to the employer. Employers may want to know how you will aspire to work as error free as possible. While perfection is a high aspiration, explaining your methods in perfectionism may leave a good impression on the interviewer if done so honestly.

Example:”I’m not perfect, but I try to prioritize correctness over work-speed. The method I use that’s worked so far is to triple-check and compare once before it leaves my work-station. The most challenging part of this is that in my previous workplace, work-speed was important. Often I was pushed to question if I really needed the extra care when work was becoming backed-up throughout the day. In the end, I tried very hard to prioritize doing quality work over quantity.”

What Does An Accounts Payable Clerk Do

An accounts payable clerk has many duties as a part of their job. Your role as an accounts payable clerk is to verify and reconcile invoices for a company or organization. Your training would concern all aspects of invoice management from first receiving the invoices to processing the invoices. Some responsibilities you may have as an accounts payable clerk are:

-

Verifying the accuracy of invoices

-

Inputting the invoices into a computer system

-

Paying company bills monthly, weekly or daily

-

Maintaining a list of all the vendors a company uses for business

-

Keeping record of what the company owes to the vendors and what vendors owe to the company

-

Printing monthly financial statements

-

Reporting sales taxes on paid invoices

Related:Learn About Being an Account Clerk

Don’t Miss: How To Say Thank You For Interview

Regarding Culture What Environment Do You Feel You Do Your Best Work In

Work culture is huge and for good reason these days. Its more than simply the way things are done, its how things are done and why. Youll want to be careful here, indicating that you are able to thrive in a variety of work enviornments.

Answer Sample:

I succeed when given clear expectations of me and my team, and find a balance of working individually as well as alongside a team is when Im most content

Which Accounting Software Have You Used In Previous Roles

Although candidates may not have always used the accounting software your organization uses, look for evidence that they can adapt to new software and are eager to learn a new system.

For example, they may have used software like Zoho Books, QuickBooks, or FreeAgent. But if your organization doesnt use these, you should try to figure out during the interview whether they could learn how to use your software.

Read Also: How Do You Prepare For A Job Interview

Accounts Payable Interview Assessable Skills Qualities & Attributes:

- FOCUS ON ATTENTION TO DETAIL An Accounts Payable Clerk must be able to focus intently on their task and not make mistakes. A mistake can cost the organization dearly in financial terms, and can also have a negative impact on employee morale, especially if payments are late or inaccurate.

- NUMERICAL ABILITY Although the majority of accounting software packages will do this for you, you should have a thorough understanding of tax rates applicable for your country, including VAT and National Insurance. You should also be able to carry out basic numerical calculations.

- WORKING TO DEADLINES AND TIMESCALES It is essential that, as an Accounts Payable Clerk, you are able to work to strict timescales in respect of paying invoices and also paying employee wages and bills.

- CONTINUOUS PROFESSIONAL DEVELOPMENT You will need to demonstrate an ability to be self-motivated, embrace changes that come into the organization in respect of financial regulations and tax rates, and also keep up-to-date with new accounting software and financial industry regulations.

Things Are Changing Quickly In Our Industry What Do You Feel Are The Biggest Challenges Within The Role Of Accounting Analyst

There are a variety of ways to answer this one. These days, mentioning Artificial Intelligence, software, and related items should do well. Regardless of your answer, be sure to have something to backup your responses.

Answer Sample:

Its hard to know for sure with industry factors such as x and y changing so many things all I can say is that Im excited for the challenges that come with that

Also Check: Questions About Leadership For Interview

What Does Accounts Payable Mean

Accounts payable refers to an amount a business owes its suppliers or vendors for their services or goods. The amount is usually outstanding, meaning that the services or goods have not been paid for yet. The total of the outstanding payments owed to vendors will appear on the companys balance sheet.

If the accounts payable amount increases or decreases, the cash flow statement will show these changes in the total.

Which Phases Does The Working Capital Cycle Include

There are four key phases that the working capital cycle includes. These are:

- Cash flow: the inflows and outflows of cash from your enterprise that ensure the cash balance is healthy.

- Receivables: the terms of payment for the money owed for services and goods.

- Selling inventory: the length of time taken to sell the inventory.

- Billing suppliers: the length of time available to make a payment to suppliers.

You May Like: How To Prepare For An Online Interview

I: Top 10 Common Accounts Payable Analyst Interview Interview Questions And Answers

1. Accounts payable analyst interview question: Tell me a little about yourself?Top 5 answer samples to question tell me about yourself2. Accounts payable analyst interview question: What are your greatest strengths?3. Accounts payable analyst interview question: What do you consider to be your weakness?4. Accounts payable analyst interview question: Where do you see yourself in five years?5. Accounts payable analyst interview question: What is your greatest professional achievement?6. Accounts payable analyst interview question: Why are you leaving your current job?7. Accounts payable analyst interview question: Why are you interested in working here?8. Accounts payable analyst interview question: Why should we hire you?9. Accounts payable analyst interview question: What are your salary requirements?10. Accounts payable analyst interview question: Do you have any question for us?

What Is The Meaning Of Tds How Is It Charged

TDS is an acronym that stands for Tax Deducted at Source. It is charged on the Base Amount. It is a simple tax deduction process. Under this process, if a person is liable to make payment to any other person , will deduct tax at the source and transfer the balance amount to the deductee. The deducted TDS amount will be remitted to the Central Government.

There are mainly two different types of TDS:

- TDS on salaried employees: TDS on salaried employees must be deducted from the salary paid to the employer if it crosses the tax limit. This money has to be paid to the government on or before the due date.

- TDS on contractors and other professionals: In TDS on contractors or other professionals, there is a slab that min tax, surcharge, education cess plus higher education cess. The finance minister regulates it, and they can make changes or keep the same or remove in every year budget. You can deduct the TDS on the bill amount while paying or if an advance is paid.

Also Check: How To Ace The Google Interview

Do You Consider Yourself A People Person

Employers not only ask this to further understand how well you will work with their team, but also if you will work well with clients. Accounts receivable clerks work with clients and coworkers daily, so it is imperative that they are open and engaging in social settings during a workday. Consider presenting yourself in a friendly and open manner throughout the interview to solidify with your employer that you are social and easy to talk to.

Example:”In a previous position, I took calls for almost the entirety of my work experience in the company. I found the social nature of it easy and almost preferable to working in a setting that involved more desk work. However, in my most recent position, I’ve encountered my share of both and can say that I enjoy both working with people and alone. Neither is difficult for me.”

Accounts Payable Interview Questions

The Indeed Editorial Team comprises a diverse and talented team of writers, researchers and subject matter experts equipped with Indeed’s data and insights to deliver useful tips to help guide your career journey.

Related: A Day in the Life of an Accountant

In this video, we follow Ektaa, a tax accountant working for a family-owned accounting firm, as she shares the skills and education needed to be a successful accountant.

A career in accounts payable can be a rewarding path for those with an interest in math and administration. Beginning a career in this role starts with an interview to assess your education, skills, and compatibility. Preparing for your interview by researching common questions and rehearsing your answers can help you communicate effectively during meetings. In this article, we discuss accounts payable interview questions, detail the different types of inquiries, list common examples, and outline appropriate answers that you can use as a guideline.

Related: What Is Accounts Payable? Required Duties and Skills

Read Also: How To Conduct Yourself In An Interview

What Is The Difference Between Debenture Holder And Preference Shareholder

Following is a list of significant differences between debenture holders and preference shareholders:

Debenture Holder Preference Shareholder A person having the debentures is called a debenture holder. A person holding the shares is called a preference shareholder. A shareholder could be considered as a partial owner of the company. A debenture holder needs to be paid money irrespective of the company making profits or losses. A preference shareholder earns dividends if the company is making profits. A debenture holder is only a creditor of the company. A preference shareholder is the joint owner of the company. A debenture holder earns interest on the capital invested till the capital is not returned or gets the capital invested at the end of a stipulated term. A preference shareholder is not always promised a return of the capital invested. Instead, he earns dividends till the time the company exists and is profitable. The debenture holders are not invited to attend the company’s annual general meeting unless any decision affecting their interest is taken. The preference shareholders are always invited to attend the annual general meeting of the company. The debenture holders cannot interfere with the management and regulation of the company. The shareholders can control the affairs of the company. It is managed by the Board of Directors and the elected representatives of the shareholders. Debentures can be converted into shares.